Real Growth: SIP returns vs Inflation in the Indian Economy

Highlights

SIP Calculator

It is 6:30 AM in Kallakurichi, Tamil Nadu.

Our friend, Shankaran Pillai, is standing at the local Aavin milk booth, adjusting his veshti. He hands over a ₹50 note for a packet of Full Cream milk and waits for the change. He gets a few coins back.

He stares at the coins, puzzled. “Anna, didn’t this used to cost ₹24 just a few years ago? Now it is ₹36?”

The shopkeeper just shrugs, “Sir, petrol prices went up, fodder prices went up. What can we do? Even the tea shop across the road charges ₹12 for a cutting chai now.”

Shankaran walks back home, calculating. His salary hasn’t doubled in the last 8 years, but the price of milk, petrol, and his daughter’s school fees certainly feel like they have.

This is the reality for every middle-class Indian household. We work hard, we save in our bank accounts, but we still feel like we are falling behind. Why? Because of the battle between SIP returns vs Inflation.

If you are keeping your money in a Savings Account or a traditional Fixed Deposit (FD), thinking you are playing it safe—I have bad news for you. You are losing money every single day.

Let’s sit down with a cup of filter coffee and understand why.

The Villain: Understanding Cost of Living in India

Inflation is not just a statistic used by economists on news channels. It is a silent thief that puts its hand in your pocket and shrinks your money.

Let’s look at the Cost of Living India scenario.

In 2010, ₹100 could buy you roughly 1.5 litres of petrol.

In 2024, that same ₹100 buys you less than 1 litre.

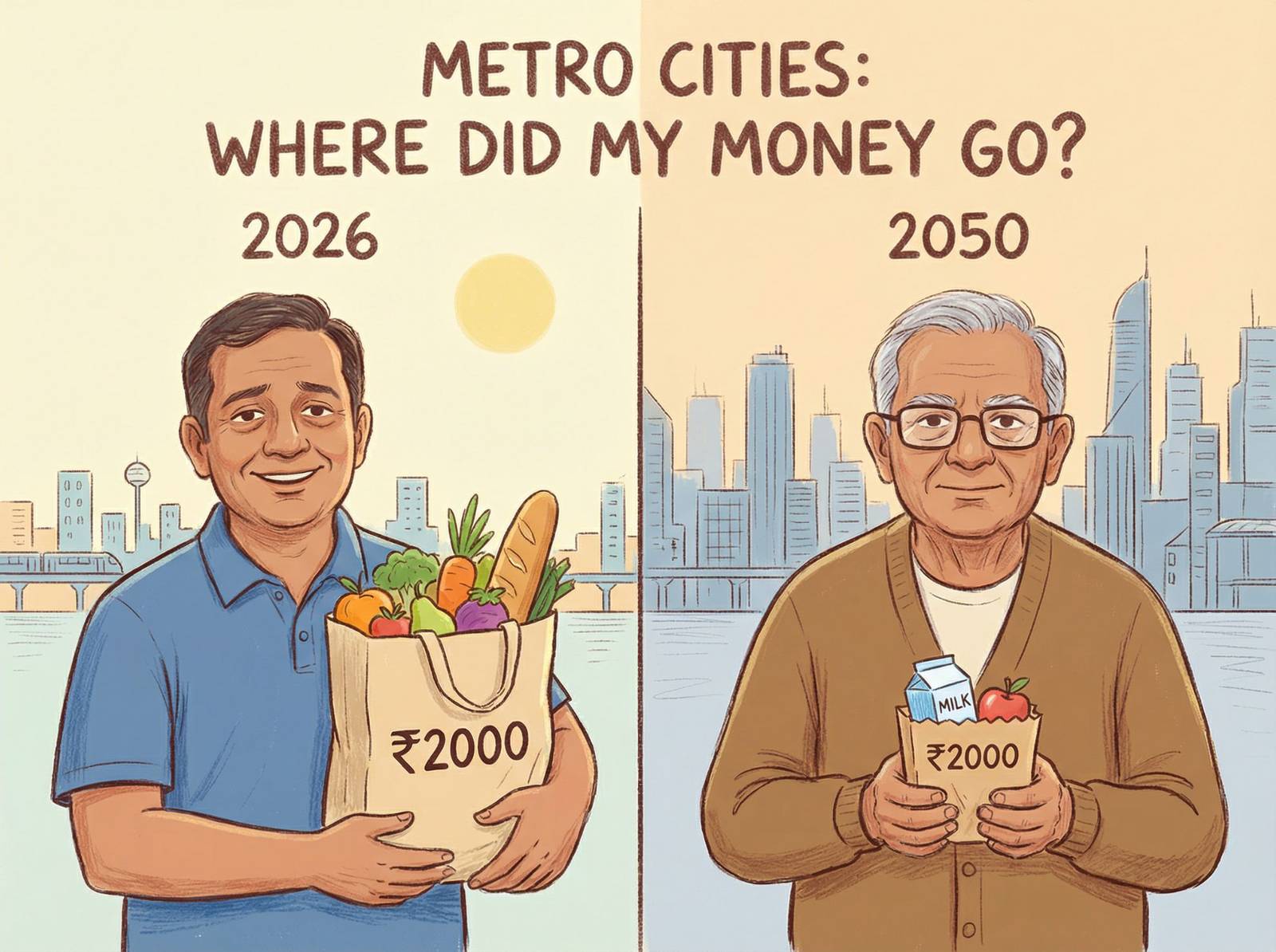

The note in your pocket is still pink or purple, and it still says “₹100” or “₹2000” (if you can find one), but its purchasing power has dropped.

The “Safe” Investment Trap

Shankaran Pillai is a conservative man. He trusts his nationalised bank. He loves the Fixed Deposit because “Capital Protection” is his motto.

- Bank FD Interest Rate: 7.0% (if he is lucky).

- Consumer Price Inflation (CPI): 6.0% (average over the long term).

On paper, Shankaran thinks, “I made a 1% profit!”

Wrong.

If Shankaran falls in the 30% tax bracket, his post-tax return on that FD is roughly 4.9%.

If inflation is 6%, his Real Rate of Return is:

4.9% – 6.0% = -1.1%

Every year, his wealth effectively shrinks by 1.1%. He is not saving; he is slowly becoming poorer while feeling safe.

The Hero: SIP Returns vs Inflation

This is where the Systematic Investment Plan (SIP) in Equity Mutual Funds enters the chat.

When you invest in an Equity SIP, you are buying small parts of companies (Tata, Reliance, Infosys, HDFC). As the Indian economy grows, these companies grow, and so does your money.

Historically, the Nifty 50 (India’s top 50 companies) has given returns of roughly 12% to 14% CAGR over long periods (10-15 years).

Let’s look at the math again:

- SIP Return: 13% (Assumption).

- Inflation: 6%.

- Real Rate of Return: +7%.

This is Real Growth. This is how you beat price rise.

Shankaran’s Milk Experiment: A 10-Year Comparison

Let’s go back to Shankaran Pillai. Imagine it is the year 2014. He has ₹5,000 surplus every month.

Scenario A: He puts it in a Recurring Deposit (RD) at 6%.

Scenario B: He starts an SIP in a Flexi-cap Fund (Equity) at 12%.

Fast forward to 2024 (10 years later). Total investment: ₹6 Lakhs.

| Investment Type | Total Invested | Final Corpus Value (Approx) | Purchasing Power Status |

| Recurring Deposit (RD) | ₹6,000,000 | ₹8.1 Lakhs | Barely kept up with inflation. Can buy the same amount of goods as in 2014. No lifestyle upgrade. |

| Equity SIP | ₹6,000,000 | ₹11.5 Lakhs | Wealth Created. He has beaten inflation significantly. He can buy the goods AND a small car. |

Note: Returns are for illustration. Mutual Funds are subject to market risks.

By choosing SIP returns vs Inflation, Shankaran didn’t just save; he grew his wealth.

The “Education Inflation” Monster

If you think grocery inflation is bad, let me introduce you to the scariest villain for Indian parents: Education Inflation.

While milk prices rise at 6%, private college fees in India rise at roughly 10% to 12% per year.

Shankaran’s daughter, Lakshmi, is 8 years old today. He wants her to do an Engineering degree when she turns 18.

- Current Cost of Engineering (4 Years): ₹10 Lakhs.

- Cost in 10 Years (at 10% inflation): ₹26 Lakhs.

If Shankaran uses an FD or Savings account, he will need to save roughly ₹15,000 per month to reach ₹26 Lakhs.

If he uses a SIP (expecting 12%), he needs to save only ₹11,000 per month.

That difference of ₹4,000 per month is huge for a middle-class family. It is the difference between living comfortably and pinching pennies.

Why Do Indians Fear SIPs? (And Why They Shouldn’t)

Shankaran Pillai often tells me, “Ayyo, but the Stock Market is like gambling! What if the market crashes?”

It is a valid fear. In 2020 (Covid), the markets fell by 40%. In 2008, they fell by 50%.

But here is the secret: Volatility is the fee, not the fine.

If you are investing for 6 months, do not touch SIPs. Put it in the bank.

But if you are investing for 5, 10, or 15 years (for Lakshmi’s marriage or your retirement), the market always recovers and goes up.

When the market falls, your SIP instalment buys more units at a cheaper price (like buying onions when the price drops to ₹20/kg). When the market goes up, the value of those units skyrockets. This is called Rupee Cost Averaging.

How to Shield Yourself: An Action Plan

You don’t need to be a Wolf of Dalal Street. You just need to be a disciplined Shankaran Pillai.

- Calculate Your “Real” Need:

Don’t just look at the price today. Use a “Future Value of Money” calculator. If you need ₹1 Crore for retirement today, you will actually need ₹3 Crores in 20 years. - Move Beyond the Savings Account:

Keep 6 months of expenses in the bank (Emergency Fund). Move the rest. - Start Small, But Start Now:

You can start a SIP with as little as ₹500. The key is consistency. - Step-Up Your SIP:

Every time you get a hike or a Diwali bonus, increase your SIP amount by 10%. This is the turbo-charger for your wealth.

Final Thoughts from Kallakurichi

Inflation is like humidity in Chennai or Mumbai—it is always there, it is uncomfortable, and you cannot wish it away.

You cannot control the price of petrol at the bunk. You cannot control the fees at the international school.

The only thing you can control is how hard your money works for you.

Don’t let your hard-earned rupees sit lazy in a savings account, getting eaten away by the moths of inflation. Put them to work in the Indian economy.

The next time Shankaran Pillai buys milk for ₹40 or ₹50, he won’t worry. Why? Because his SIP portfolio has grown enough to pay for the milk and the coffee powder too.

Be smart. Choose Real Growth.