Missed EMI payment consequences: CIBIL Score Impact & Fees

Highlights

EMI Calculator

We have all been there. The month-end approaches, your salary is delayed, or a client payment hasn’t cleared yet, but the date for your Home Loan or Personal Loan deduction is staring you in the face.

You might think, “It’s just one month. I will pay double next month. What is the big deal?”

Let me introduce you to Shankaran Pillai, a hardworking small business owner from Kallakurichi. Like many of us, Shankaran bought a bike on EMI to help with his daily commute. Business was slow one month during the monsoon, and he decided to skip his EMI of ₹4,500, thinking he would manage it later.

He didn’t speak to the bank. He just let the auto-debit bounce.

Three months later, Shankaran wasn’t just fighting penalty fees; he was fighting a legal notice and a ruined reputation that stopped him from getting a business loan when he really needed it.

Missing an EMI in India is not just about paying a fine. It sets off a chain reaction that affects your wallet, your peace of mind, and your future. Let’s break down exactly what happens when that payment fails, and how you can fix it.

1. The Immediate Hit: Your Bank Balance Bleeds

The moment your EMI bounces (due to insufficient funds), two things happen instantly. Your bank and the lender both charge you.

The “Double Whammy” of Charges

Let’s look at the numbers. If Shankaran Pillai misses his payment, he faces:

- Cheque/NACH Bounce Charges: Your bank (where you have your savings account) will penalise you for the failed mandate.

- Late Payment Fees: The lender (the bank who gave you the loan) will charge a late fee.

EMI bounce charges SBI/HDFC (Approximate figures):

- SBI/HDFC/ICICI (Bank Side): Typically between ₹400 to ₹600 plus 18% GST per bounce.

- Lender Late Fee: Usually 2% to 3% of the overdue EMI amount per month.

The Math:

If your EMI is ₹15,000 and you miss it:

- Bounce Charge: ₹590 (₹500 + GST)

- Late Fee: ₹450 (3% of EMI)

- Total Loss: ₹1,040 just for missing one date.

That is the cost of a good family dinner gone in seconds. And remember, if you try to pay again and it bounces a second time, the charges apply again.

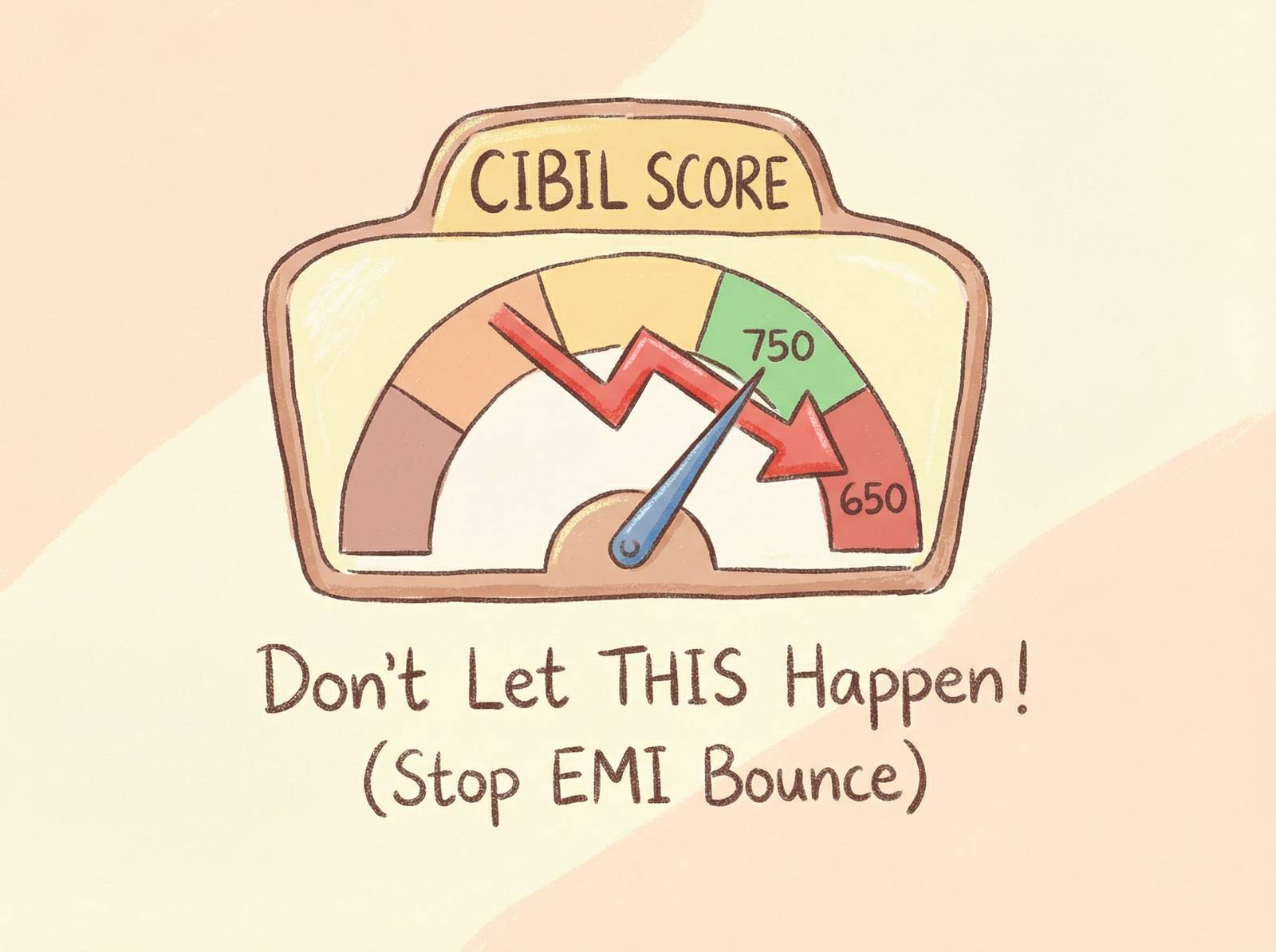

2. The Silent Killer: Your CIBIL Score Impact

Money comes and goes, but your Credit Score sticks with you. In India, CIBIL (TransUnion) is the holy grail for lenders.

When Shankaran missed his payment, the bank reported it to the credit bureaus.

- Minor Default: If you pay within 90 days, your score drops by 30-50 points.

- Major Default: If you go beyond 90 days, your account is tagged as NPA (Non-Performing Asset). This can crash your score by 100+ points.

Why does this matter?

If your score drops below 750, future loans become difficult. Even if you get one, banks will charge you a higher interest rate. You might end up paying 14% interest on a Personal Loan while your neighbour with a good score pays 10.5%.

The “Settled” Trap:

Sometimes, recovery agents will offer you a deal: “Pay 50% of the amount now, and we will close the loan.”

Do not do this.

This marks your account as “Settled” in your credit report, not “Closed.” A “Settled” tag tells every future bank that you defaulted and could not pay the full amount. It is a black mark that stays for years.

3. The Legal Nightmare: Can You Go to Jail?

This is the question that keeps people awake at night. Can the police arrest Shankaran Pillai for missing a bike EMI?

Generally, defaulting on a loan is a civil dispute, not a criminal one. You will not go to jail for being unable to pay. However, there are exceptions you must know about.

Section 138 of the Negotiable Instruments Act

If your EMI was set up via a Post-Dated Cheque (PDC) and it bounces, the bank can file a case against you under Section 138.

- This is a criminal offence.

- It can lead to imprisonment for up to 2 years or a fine twice the amount of the cheque.

SARFAESI Act (For Secured Loans)

If you have a Home Loan or Loan Against Property and you miss payments for 3 consecutive months (90 days), the bank can initiate proceedings under the SARFAESI Act.

- They can take possession of your asset (house/shop) without court intervention to recover their dues.

Legal notice for non-payment of personal loan:

Before any of this happens, the bank must send you a notice. If you receive a legal notice, do not ignore it. Reply to it stating your financial difficulty. Ignoring it makes you look like a “Willful Defaulter” (someone who has money but refuses to pay).

4. Recovery Agents: Know Your Rights

We have all heard horror stories of recovery agents creating a scene. But the Reserve Bank of India (RBI) has very strict guidelines.

What Agents CANNOT Do:

- Call you before 8:00 AM or after 7:00 PM.

- Use abusive language or threaten you.

- Harass your family members or neighbours.

- Visit your home without prior notice.

If an agent crosses the line, you can file a complaint with the bank’s nodal officer or the RBI Ombudsman. You have rights, even if you owe money.

5. The “Shankaran Strategy”: How to Handle the Situation

Let’s rewind. If Shankaran Pillai knew he was going to miss the payment, what should he have done?

Most people in India switch off their phones when the bank calls. That is the worst mistake. The bank assumes you are running away.

The Competitor Gap: The “Pre-Bounce” Email Template

If you are a freelancer with irregular income or facing a medical emergency, communicate before the bounce. Send this email to your branch manager or customer support 3-4 days before the EMI date.

Subject: Request for EMI Rescheduling / Moratorium – Loan A/c [Your Loan Number]

Dear Manager,

I am writing to you regarding my Personal Loan (A/c: XXXXXXXX) with your branch.

I have been a consistent payer of my EMIs for the last [Number] months. However, due to [Reason: e.g., delayed salary/medical emergency/business loss], I am facing a temporary liquidity crunch this month.

I kindly request you to consider one of the following options:

1. Allow me a grace period of 10 days to make the payment without penalty.

2. Restructure my loan to increase the tenure and reduce the monthly EMI amount.

I am committed to clearing my dues and maintaining a good credit history. I am willing to visit the branch to discuss this further.

Regards,

[Your Name]

[Phone Number]

Sending this creates a written record that you are a willing payer, just facing a temporary issue. Banks are often willing to help genuine customers rather than spending money on legal notices.

6. How to Improve CIBIL After Bounce

So, the damage is done. You missed a payment. Is it over? No.

Here is how to fix it:

- Pay Immediately: Do not wait for the next month. Pay the overdue amount + penalty immediately.

- Regularize Future Payments: Ensure the next 6-12 EMIs are paid exactly on time. Consistency heals the score.

- Avoid New Loans: Do not apply for a new Credit Card or loan for at least 6 months. Every rejection drops your score further.

- Check Your Report: Sometimes, even after you pay, the bank forgets to update CIBIL. Check your report after 45 days and raise a dispute if the status still shows “Overdue.”

7. Advice for Freelancers and Gig Workers

If you are a freelancer, a graphic designer, or run a small catering business, your income isn’t fixed like a government salary.

- The “2-Month Rule”: Always keep 2 months’ worth of EMI in a separate Recurring Deposit (RD) or a Liquid Fund. This is your safety net.

- Change the EMI Date: If your clients usually pay you by the 10th, do not set your EMI date for the 5th. Ask the bank to shift it to the 15th.

- Calculate Before You Commit: Before taking a loan, be realistic. Don’t just look at the interest rate; look at the monthly burden.

Use our Smart EMI Calculator to plan your payments better. It helps you see exactly how much cash flow you need every month so you never end up in Shankaran’s situation.

Conclusion

Missing an EMI is stressful, but it is not the end of the world. The banking system in India is designed to recover money, not to destroy lives—unless you go silent.

Be proactive. Talk to the bank. Use the email template provided above. And most importantly, manage your finances so you have that buffer. Whether you are in a Metro city or a town like Kallakurichi, financial discipline is the only way to build wealth.

Don’t let a small slip-up become a permanent scar on your financial profile.

Frequently Asked Questions (FAQs)

Q1: Can I pay my EMI in cash at the branch after it bounces?

Yes, you can. Visit your nearest branch, deposit the cash, and keep the receipt. Ensure they update the system to stop further late fees.

Q2: Will one missed EMI affect my Home Loan eligibility?

One missed payment is usually manageable if regularized quickly. However, frequent bounces (3 or more) will make banks view you as “High Risk,” leading to rejection of large loans like Home Loans.

Q3: Can the bank take my car if I miss one EMI?

No. Usually, banks wait for 90 days (NPA status) before initiating asset seizure. However, they will start calling you immediately.