Tax Saving SIP (ELSS): Save ₹46,800 and Grow Wealth

Highlights

SIP Calculator

Introduction: The “March Madness” Email from HR

It happens every year around January or February. Shankaran Pillai, a diligent software engineer from Kallakurichi working in Bengaluru, receives an email from his HR department. The subject line is usually in bold red letters: “URGENT: SUBMIT INVESTMENT PROOFS.”

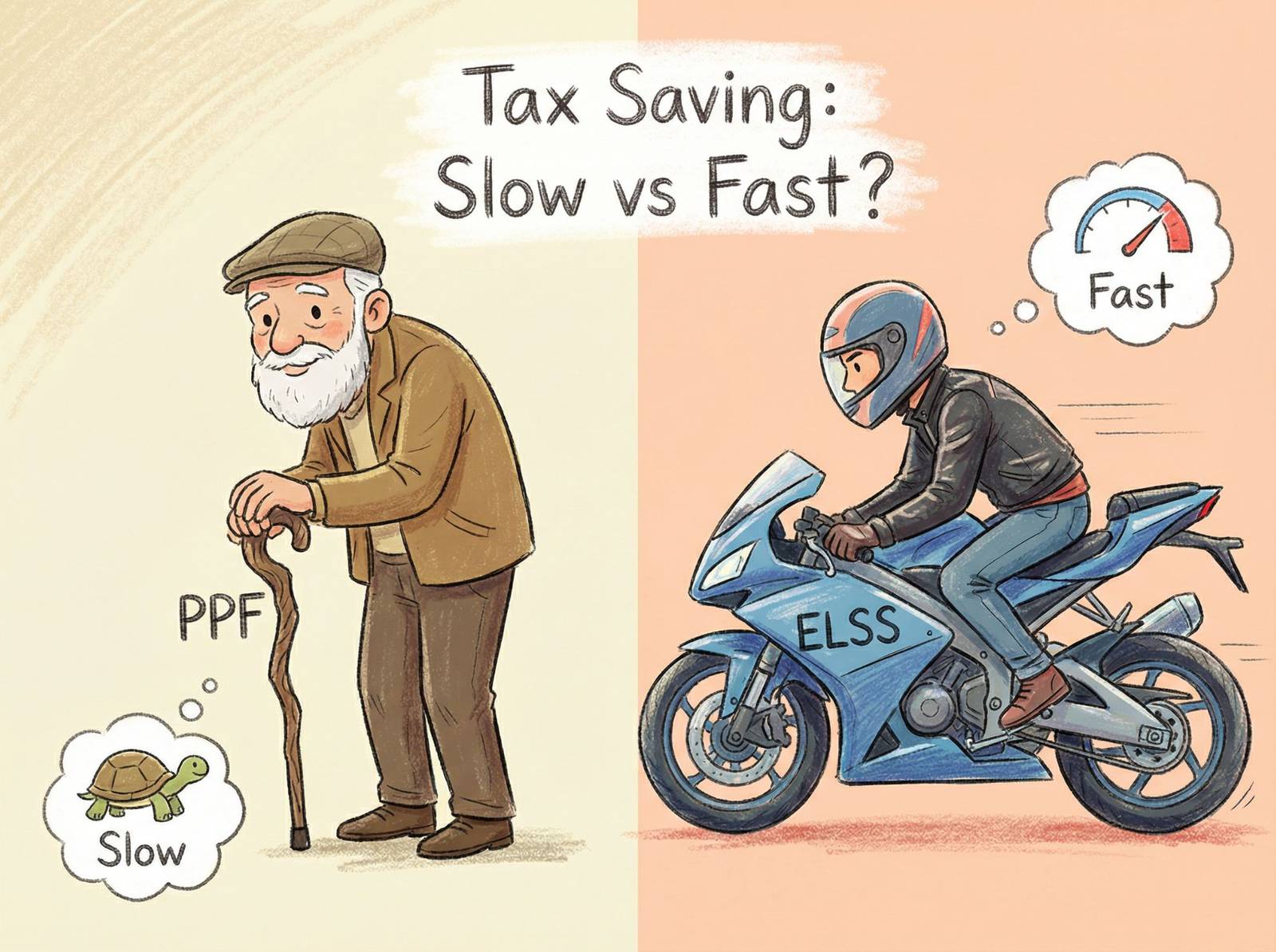

Shankaran panics. He calls his father, who inevitably says, “Go to the bank and put money in PPF or buy that LIC policy your uncle is selling.”

For years, this has been the standard Indian operating procedure. We scramble to find any instrument that satisfies Section 80C, lock our money away for 15 or 20 years, and accept whatever returns (usually 6% to 7%) come our way. We save the tax, but we lose the opportunity to grow wealth.

But here is the truth the bank manager won’t tell you: You can save that same tax and potentially earn double the returns by starting a Tax Saving SIP in Equity Linked Savings Schemes (ELSS).

If you are young, earning a salary, and can handle a little bit of market volatility, ELSS is not just a tax-saving tool; it is a wealth-creation machine. Let’s break down why Shankaran Pillai needs to stop listening to his uncle and start looking at the numbers.

What is a Tax Saving SIP (ELSS)?

Before we get into the math, let’s clear the jargon.

ELSS stands for Equity Linked Savings Scheme. It is a type of mutual fund that invests primarily in the stock market (equity). The Government of India allows you to claim a deduction of up to ₹1.5 Lakhs per financial year under Section 80C for investing in these funds.

A Tax Saving SIP is simply the method of investing in these funds. Instead of dumping ₹1.5 Lakhs in one go in March (Lumpsum), you invest small amounts (e.g., ₹12,500) every month throughout the year.

The “Twin Engine” Advantage

- Tax Deduction: You lower your taxable income. If you are in the 30% tax bracket, investing ₹1.5 Lakhs saves you ₹46,800 (Tax + Cess).

- Wealth Creation: Since the money is invested in the stock market, you have the potential to earn 12-15% returns over the long term, unlike the fixed 7.1% of PPF.

ELSS vs. PPF vs. LIC: The “Kitna Deti Hai” Comparison

In India, we ask mileage for cars and returns for investments. Let’s compare the traditional heavyweights against the Tax Saving SIP.

| Feature | PPF (Public Provident Fund) | Traditional LIC/Endowment Plans | ELSS (Tax Saving Mutual Fund) |

| Returns | Fixed (~7.1%) | Low (~5-6%) | High Potential (12-15%) |

| Lock-in Period | 15 Years | Often 10-20 Years | 3 Years (Shortest) |

| Risk | Zero (Govt Backed) | Low | Moderate to High |

| Liquidity | Very Low | Low | Moderate (After 3 years) |

| Inflation Beating? | Barely | No | Yes |

Shankaran’s Realization:

Shankaran notices that while PPF is safe, his money is locked for 15 years. If he needs money for his marriage or a down payment on a flat in 5 years, he can’t touch the PPF. With ELSS, the money is free (though taxable) after just 3 years.

Why SIP is Better than Lumpsum for Tax Saving

Many people wait until March 25th to make a one-time investment. This is risky. If the market is at an all-time high on that day, you buy fewer units.

A SIP (Systematic Investment Plan) works on the principle of Rupee Cost Averaging.

Think of it like buying onions for your home.

- In January, onions are ₹20/kg. You buy 5 kgs for ₹100.

- In February, onions are ₹50/kg. You buy 2 kgs for ₹100.

- In March, onions are ₹25/kg. You buy 4 kgs for ₹100.

By spending a fixed amount every month, you automatically buy more when prices are low and less when prices are high. Over time, your average cost of purchase goes down.

A Tax Saving SIP ensures you don’t have to stress about market timing. You just set it and forget it. plus, looking for ₹1.5 Lakhs in March is stressful. Finding ₹12,500 from your monthly salary is manageable.

The Shankaran Pillai Scenario: The ₹50 Lakh Difference

Let’s put money on the table.

Shankaran is 25 years old. He decides to invest ₹10,000 per month to save tax under Section 80C. Let’s compare his future if he chooses PPF vs. if he chooses a Tax Saving SIP in an ELSS fund.

Scenario A: The Safe Route (PPF)

- Investment: ₹10,000/month

- Duration: 15 Years

- Rate of Return: 7.1% (Assumed constant)

- Total Invested: ₹18 Lakhs

- Maturity Value: ₹31.5 Lakhs (approx)

Scenario B: The Wealth Route (ELSS SIP)

- Investment: ₹10,000/month

- Duration: 15 Years

- Rate of Return: 12% (Historical average of equity markets)

- Total Invested: ₹18 Lakhs

- Maturity Value: ₹50.4 Lakhs (approx)

The Result:

By taking a calculated risk with ELSS, Shankaran is richer by nearly ₹19 Lakhs. That is the price of a decent SUV or a substantial chunk of a home loan!

If the market performs better (say 14%), the ELSS corpus jumps to ₹61 Lakhs. This is the power of compounding combined with equity exposure.

Important: Understanding the Lock-in Period

This is where many first-time investors get confused.

ELSS has a 3-year lock-in. This means you cannot withdraw the money before 3 years from the date of investment.

However, in a Tax Saving SIP, each installment has its own 3-year lock-in.

- SIP Installment paid on Jan 1, 2024 is free to withdraw on Jan 1, 2027.

- SIP Installment paid on Feb 1, 2024 is free to withdraw on Feb 1, 2027.

You cannot withdraw the entire lump sum 3 years from the start date. You must calculate the lock-in for each unit purchased.

Pro Tip: Don’t withdraw just because the 3 years are up. Equity funds work best over 5-7 years. Treat the lock-in as a minimum, not a target.

Taxation on Withdrawals (LTCG)

“But Shankaran, what about tax on the returns?”

Good question.

- PPF Returns: Tax-Free.

- ELSS Returns: Taxable under Long Term Capital Gains (LTCG).

The Rule: Gains up to ₹1.25 Lakhs in a financial year are Tax-Free. Any profit above ₹1.25 Lakhs is taxed at 12.5%.

Even after paying the 12.5% tax on profits, the post-tax returns of ELSS usually beat PPF and Fixed Deposits by a wide margin because the base return is so much higher.

How to Select the Best ELSS Fund?

Do not just Google “Best ELSS fund 2024” and pick the top one. Rankings change every year. Use this checklist:

- Fund History: Has the fund performed consistently for at least 5 to 7 years? (Don’t look at just 1-year returns).

- Fund Manager: Is the fund manager experienced? Have they been with the fund for a while?

- Expense Ratio: This is the fee the fund house charges. A Direct Plan always has a lower expense ratio than a Regular Plan. Always choose Direct Growth plans to save an extra 1% in commissions.

- Portfolio Overlap: If you already invest in other mutual funds, check if the ELSS fund holds the exact same companies. Diversification is key.

Conclusion: Don’t Panic, Plan.

The financial year ending on March 31st should not be a time of panic for you. It should be a simple box-ticking exercise because your Tax Saving SIP has been running automatically since April.

If you are young, living in a metro or Tier-2 city, and have a steady income, relying solely on PPF is playing too safe. Inflation in India is roughly 6-7%. If your investment earns 7%, you are effectively earning zero real returns.

Be like the smart version of Shankaran Pillai. Take advantage of the volatility. Save your ₹46,800 in tax, but more importantly, build a corpus that will actually help you achieve your dreams—whether that’s a Europe trip, a big wedding, or early retirement.

Action Item: Check your Section 80C limit today. If you have a gap, start a SIP or make a lumpsum investment in an ELSS fund before the bank servers crash on March 30th!