SIP vs Recurring Deposit: Why Shankaran Pillai Finally Switched

Highlights

SIP Calculator

Let me introduce you to our friend, Shankaran Pillai from Kallakurichi, Tamil Nadu.

Shankaran is a sensible man. He works hard, rides a reliable Honda Activa, bargains for vegetables at the Sunday market, and absolutely loves his PSU Bank Passbook. For years, the highlight of his month was walking into the bank branch, hearing the chuk-chuk-zzzt sound of the dot-matrix printer, and seeing his balance grow by a few thousand rupees.

He has been running a Recurring Deposit (RD) since 2010. He believes in safety first. “Stock market is gambling, pa,” he would tell his colleagues while sipping chai.

But last month, Shankaran had a shock. He went to buy gold for his daughter’s future wedding. He realised the price of gold had doubled in the same time his RD interest had barely bought him a new mixer-grinder. He looked at his passbook, then at the jeweller’s bill, and realised something painful: His safe money was losing value.

If you are like Shankaran, relying solely on bank RDs because they feel safe, we need to have a serious chat. Let’s break down the battle of SIP vs Recurring Deposit.

The Contenders: Safety vs. Growth

Before we look at the numbers, let’s understand what we are dealing with.

1. The Recurring Deposit (RD): The Comfort Zone

An RD is the traditional Indian way of saving. You tell your bank, “Take ₹5,000 from my salary account on the 5th of every month and lock it away.”

- The Good: Guaranteed returns. You know exactly what you will get. No tension.

- The Bad: The returns are low (currently 6.5% to 7.5% for most banks).

- The Ugly: The interest is fully taxable.

2. The SIP (Systematic Investment Plan): The Wealth Builder

SIP is not a product; it is a method of investing in Mutual Funds. Just like an RD, ₹5,000 is deducted automatically. But instead of sitting in a vault, this money buys units of a Mutual Fund (usually Equity).

- The Good: Historically, equity SIPs have delivered 12% to 15% returns over the long term (10+ years).

- The Bad: It is volatile. The market goes up and down. Your portfolio might look red during a bad week.

- The Best Part: It beats inflation.

The Inflation Problem (Or, Why Shankaran’s Petrol Bill Hurts)

This is the most critical part of the SIP vs Recurring Deposit debate.

Imagine Shankaran put ₹100 in an RD a year ago. Today, the bank gives him ₹107 (7% interest).

But, the price of Petrol, Milk, and School Fees went from ₹100 to ₹107 (7% Inflation).

Result: Shankaran’s purchasing power is exactly the same. He hasn’t become richer; he just stayed afloat.

Now, if he is in the 30% tax bracket, he has to pay tax on that ₹7 interest. So, he actually takes home only about ₹104.9.

Reality Check: Inflation is ₹107. Shankaran has ₹104.9. He is poorer than he was last year.

This is why RDs are great for saving, but terrible for investing.

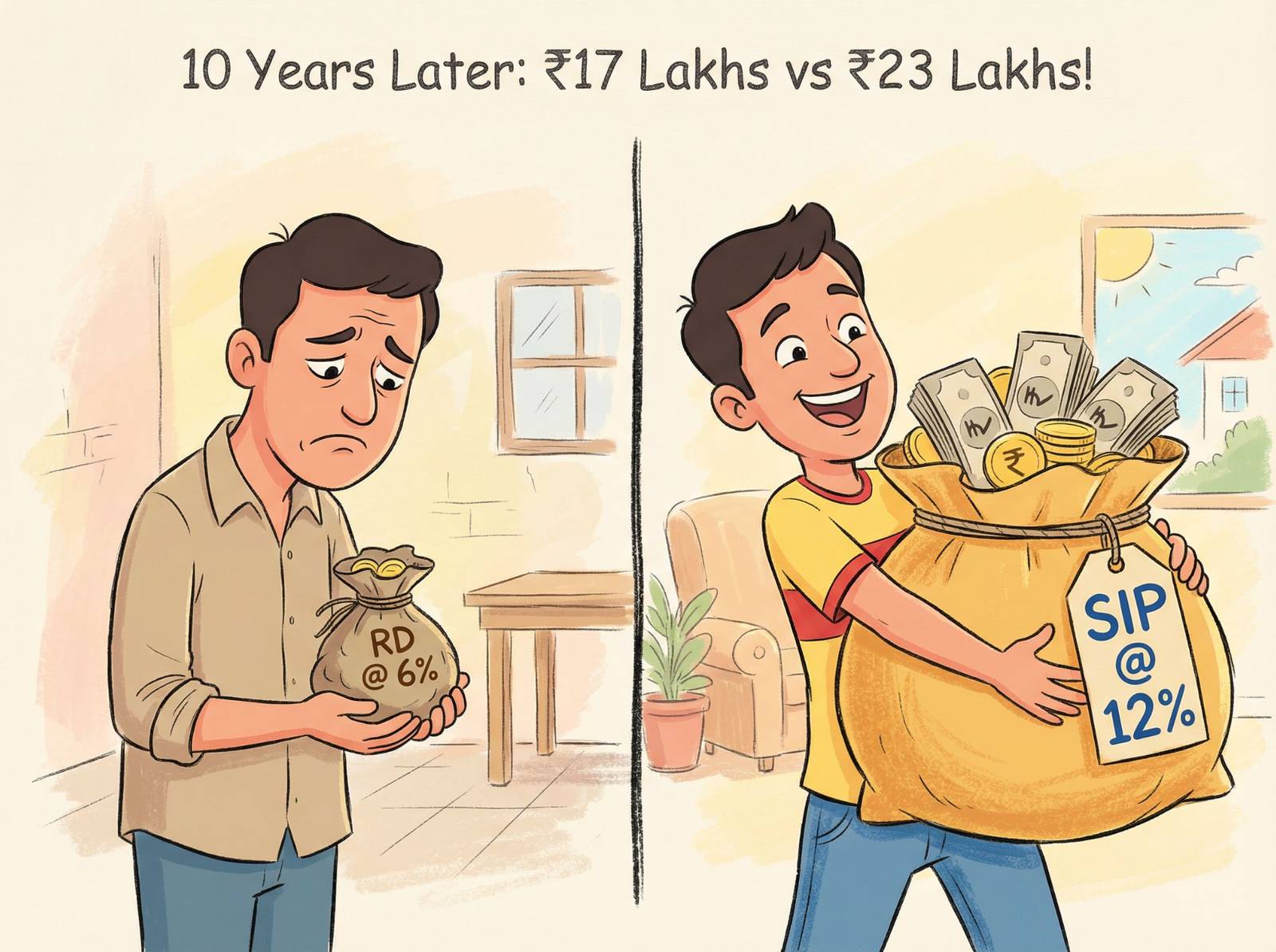

The Head-to-Head Comparison: 10-Year Challenge

Let’s look at the numbers. Shankaran decides to invest ₹10,000 per month for 10 years.

| Parameter | Recurring Deposit (RD) | SIP in Equity Fund |

| Monthly Investment | ₹10,000 | ₹10,000 |

| Total Invested (10 Yrs) | ₹12 Lakhs | ₹12 Lakhs |

| Assumed Return | 7% (Fixed) | 12% (Conservative Estimate) |

| Maturity Value | ₹17.3 Lakhs | ₹23.2 Lakhs |

| Profit | ₹5.3 Lakhs | ₹11.2 Lakhs |

| The Difference | + ₹5.9 Lakhs |

Look at that gap. By choosing safety over growth, Shankaran would lose nearly ₹6 Lakhs. That is the cost of a brand new entry-level hatchback car or a grand deposit for a home loan!

Risk vs. Volatility: Clearing the Confusion

Shankaran asks, “But sir, what if the market crashes? My RD never crashes.”

This is a valid fear. In 2008 or 2020, markets dipped. But here is the secret of the SIP:

When the market is down, your fixed monthly amount buys more units. When the market is up, you buy fewer units. This is called Rupee Cost Averaging.

Think of it like buying onions.

- Month 1: Onions are ₹20/kg. You buy 5 kgs for ₹100.

- Month 2: Onions are ₹50/kg. You buy 2 kgs for ₹100.

- Average cost? You are safe.

In an RD, you are not buying onions. You are just keeping the cash in the drawer while onion prices skyrocket.

The Tax Hammer: Where RDs Truly Fail

Many Indians ignore this. We look at the interest rate, but we forget the taxman.

1. Recurring Deposit Taxation:

The interest you earn on RD is added to your total income.

- If Shankaran earns ₹15 Lakhs a year, he is in the 30% tax bracket.

- A 7% RD return, after 30% tax and cess, effectively becomes 4.8%.

- This is way below inflation.

2. SIP (Equity Mutual Fund) Taxation:

- Short Term (< 1 year): 20% tax on profits.

- Long Term (> 1 year): You pay 12.5% tax on profits, but only if your total profit in a financial year exceeds ₹1.25 Lakhs.

- Note: The exemption limit and lower tax rate make SIPs far more efficient for wealth creation.

When to Use Which? (Shankaran’s New Strategy)

We are not saying you should close all your RDs. Banks are the backbone of our financial security. The trick is to match the instrument to the goal.

Use Recurring Deposit (RD) For:

- Emergency Fund: Money you might need in 2 days for a medical emergency.

- Short-Term Goals: Paying your child’s school fees next year, or planning a trip to Ooty in 6 months.

- Peace of Mind: If seeing a fluctuating balance gives you high BP, stick to RD. Health is wealth, after all.

Use SIP For:

- Long-Term Goals: Your daughter’s marriage (10 years away), your retirement (20 years away).

- Wealth Creation: Buying a bigger house or creating a corpus that beats inflation.

- Tax Saving: ELSS Mutual Funds (a type of SIP) help you save tax under Section 80C.

How to Switch: Advice for the “Shankaran Pillais”

If you have been trusting banks blindly, switching to SIP can feel like trying a new cuisine—scary but potentially delicious.

- Don’t jump all in: If you save ₹20,000 a month, keep ₹5,000 in RD for safety and put ₹15,000 in a Flexi-cap or Index Fund SIP.

- Think in years, not days: Do not check your SIP balance every day like a cricket score. Check it once in 6 months.

- Start small: You can start an SIP with just ₹500. See how it works for a year.

Final Thoughts

Shankaran Pillai still goes to the bank. He still likes the sound of the passbook printer. But now, the bulk of his savings for his daughter’s future is automatically deducted into an Equity Mutual Fund.

He realised that safety is important, but not becoming poor due to inflation is even more important.

In the battle of SIP vs Recurring Deposit, the winner depends on your timeline. For anything over 5 years, the SIP is the undisputed champion of the Indian middle class.