What is EMI? Meaning, Calculation & Full Form Explained (2026)

Highlights

EMI Calculator

What is EMI? Meaning, Calculation & Full Form Explained (2026)

Imagine Shankaran Pillai. He lives in Kallakurichi, a bustling town in Tamil Nadu. He has worked hard on his land for years and finally decides it is time to upgrade from a pair of bullocks to a shiny new tractor. He walks into a showroom, the AC hits his face, and the salesman starts throwing big numbers at him.

“Sir, total price ₹6 Lakhs. But don’t worry, just pay small EMI every month!”

Shankaran nods, pretending to understand. But inside, he is doing mental gymnastics. How much exactly? For how long? And is the salesman trying to pull a fast one?

If you have ever felt like Shankaran Pillai—standing at a Croma store for a phone, a car showroom, or sitting in a bank manager’s cabin—this guide is for you. Let’s break down What is EMI without the heavy banking jargon, just straight talk.

EMI Full Form and Meaning

Let’s get the basics out of the way. EMI stands for Equated Monthly Instalment.

In simple Indian English: It is the fixed amount of money you pay to a bank or lender on a specific date each month to clear your loan.

But here is the catch that most people miss. Your EMI is not just paying back the money you borrowed. It is a cocktail of two things:

- Principal Component: The actual loan amount you took.

- Interest Component: The cost of borrowing that money (the bank’s profit).

In the initial years of your loan, you are mostly paying interest. Towards the end, you pay off the principal. This is why if you try to close a home loan after 2 years, you are shocked to see the principal amount hasn’t gone down much!

The Shankaran Pillai Case Study: How EMI Actually Works

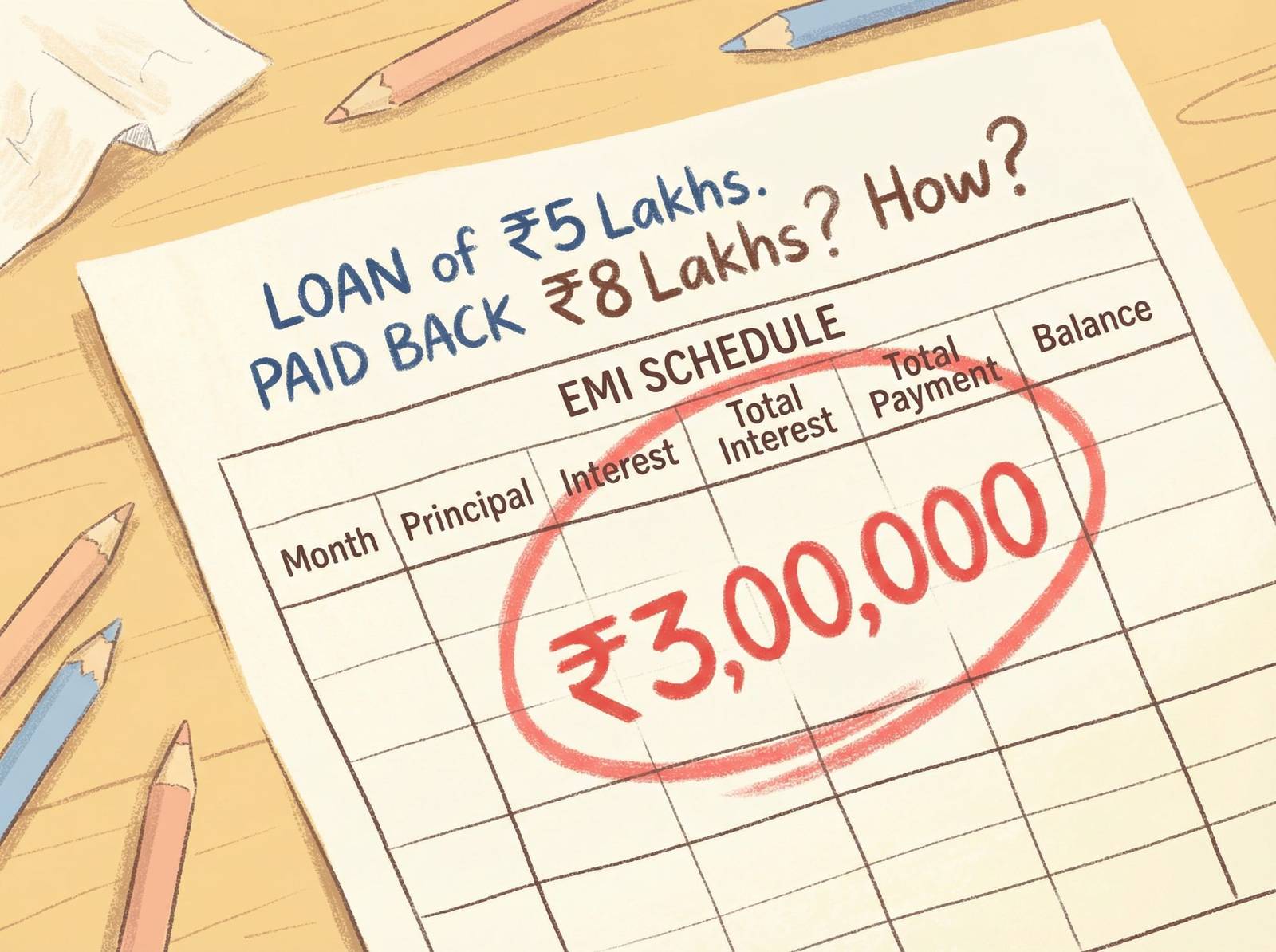

Let’s go back to Kallakurichi. Shankaran Pillai wants to buy that tractor. He needs a loan of ₹5,00,000 (5 Lakhs).

He approaches two people:

- The Bank Manager (Mr. Rao): Offers an interest rate of 10% p.a. for 5 years.

- The Private Finance Guy (Money Lender): Offers a “Flat Rate” of 7% p.a. for 5 years.

Shankaran thinks, “Arey! 7% is lower than 10%. I will go with the private finance guy.”

STOP. Shankaran is about to make a terrible financial mistake. This is where we need to explain the biggest competitor gap in the market: Reducing Balance vs. Flat Rate.

1. The Trap: Flat Rate Method

The private lender calculates interest on the entire principal (₹5 Lakhs) for the entire 5 years, even though Shankaran is paying money back every month.

- Loan: ₹5,00,000

- Rate: 7% Flat

- Tenure: 5 Years

- Total Interest: 5,00,000 x 7% x 5 = ₹1,75,000

- Total Amount to Pay: ₹6,75,000

- Monthly EMI: ₹6,75,000 / 60 months = ₹11,250

2. The Right Way: Reducing Balance Method (Bank)

The Bank calculates interest only on the outstanding balance. Every time Shankaran pays an EMI, the principal reduces, and the next month’s interest is calculated on the lower amount.

- Loan: ₹5,00,000

- Rate: 10% (Reducing Balance)

- Tenure: 5 Years

- Monthly EMI: ₹10,624

- Total Interest Paid: ₹1,37,411

The Verdict:

Even though the Bank quoted 10% and the Lender quoted 7%, the Bank is cheaper!

- Bank EMI: ₹10,624

- Lender EMI: ₹11,250

Lesson for Shankaran: Always ask, “Is this Reducing Balance or Flat Rate?” If it’s Flat Rate, run away.

EMI Calculation Formula: The Maths Part

Okay, you don’t need to be Ramanujan to understand this, but knowing the formula helps you spot errors. Most of us just use an online EMI calculator, but here is what happens in the background.

The formula banks use is:

E = P x R x (1+R)^N / [(1+R)^N-1]

Where:

- E = EMI (The amount you pay)

- P = Principal (The loan amount, e.g., ₹5 Lakhs)

- R = Monthly Interest Rate (Annual rate divided by 12 / 100)

- N = Tenure in months (e.g., 5 years = 60 months)

Why does this matter?

Because small changes in ‘N’ (Tenure) change everything.

- If Shankaran increases the tenure to 7 years, his EMI drops, but he will end up paying the bank a lot more interest over time.

Factors That Affect Your EMI

Before you sign those loan documents (or click “Buy Now” on Amazon), look at these three factors.

1. The Loan Amount (Principal)

This is obvious. You borrow more, you pay more.

Tip: Always pay a higher down payment. If the tractor costs ₹6 Lakhs, and Shankaran pays ₹2 Lakhs from his savings (Margin Money), the loan is only ₹4 Lakhs. Lower EMI, less tension.

2. Interest Rate (The Cost)

Interest rates in India fluctuate based on the RBI Repo Rate.

- Fixed Rate: The EMI stays the same for the full tenure (Good if market rates are low).

- Floating Rate: The EMI moves up or down with the market (Standard for Home Loans).

3. Tenure (The Duration)

This is the seesaw.

- Long Tenure: Low EMI, High Total Interest.

- Short Tenure: High EMI, Low Total Interest.

Pro Tip: If your salary increases or you get a Diwali bonus, use it to make a Part-Payment. This reduces your principal directly and saves you lakhs in interest.

What is “No-Cost EMI”? (The Online Shopping Trick)

You see this everywhere during the Great Indian Festival or Big Billion Days. “Buy iPhone 16 at No Cost EMI!”

Is the bank doing charity? Absolutely not.

In a No-Cost EMI, the interest you would have paid is given as an upfront discount on the product price.

Example:

- Phone Price: ₹50,000

- Interest for 6 months: ₹2,500

- Reality: The seller bills you for ₹47,500. The bank charges interest on that. Total you pay = ₹50,000.

The Catch: You lose out on the “Cash Discount.” If you had paid full cash, you might have got the phone for ₹47,000. So, you are technically paying for the convenience.

What Happens If Shankaran Misses an EMI?

Life happens. Maybe the monsoon failed in Kallakurichi, or the crop yield was low. If Shankaran misses an EMI, three things happen, and none of them are good:

- Bounce Charges: The bank will slap a penalty (usually ₹500 to ₹1000 + GST).

- Penal Interest: You pay extra interest on the overdue amount.

- The CIBIL Score Crash: This is the most dangerous. Your credit score drops. Next time Shankaran needs a loan for his daughter’s wedding or education, the bank will say “No” or charge a very high interest rate.

Frequently Asked Questions (FAQs)

Q1: Can I change my EMI date?

Yes, most banks allow you to change the EMI date (e.g., from the 5th to the 10th) to match your salary day. You just need to submit a request at the branch.

Q2: Is EMI good or bad?

It is a tool. Good if used for assets (House, Tractor, Education). Bad if used for liabilities (Luxury watches, expensive vacations) that you cannot afford.

Q3: What documents does Shankaran need for a loan?

Usually, ID proof (Aadhaar/PAN), Address proof, Bank statements (6 months), and Income proof (ITR or Salary slips). For a tractor loan, land documents (Patta/Chitta) are required.

Final Thoughts

EMI is not just a monthly deduction; it is a commitment. For people like Shankaran Pillai in Kallakurichi, or you in a metro city, understanding the math is the only barrier between financial freedom and a debt trap.

Summary Checklist before you take a loan:

- Check if it is Reducing Balance or Flat Rate.

- Use an online calculator to check affordability.

- Don’t ignore the processing fees and foreclosure charges.

- Ensure you have an emergency fund equal to 3 EMIs.

Be smart with your money. If you found this guide helpful, share it with your friends who are planning their next big purchase!