Can You Start SIP with 500 Rupees? Yes, and Here is Why You Should

Highlights

SIP Calculator

Let’s be honest for a second. If I asked you for ₹500 right now, would you panic? Probably not.

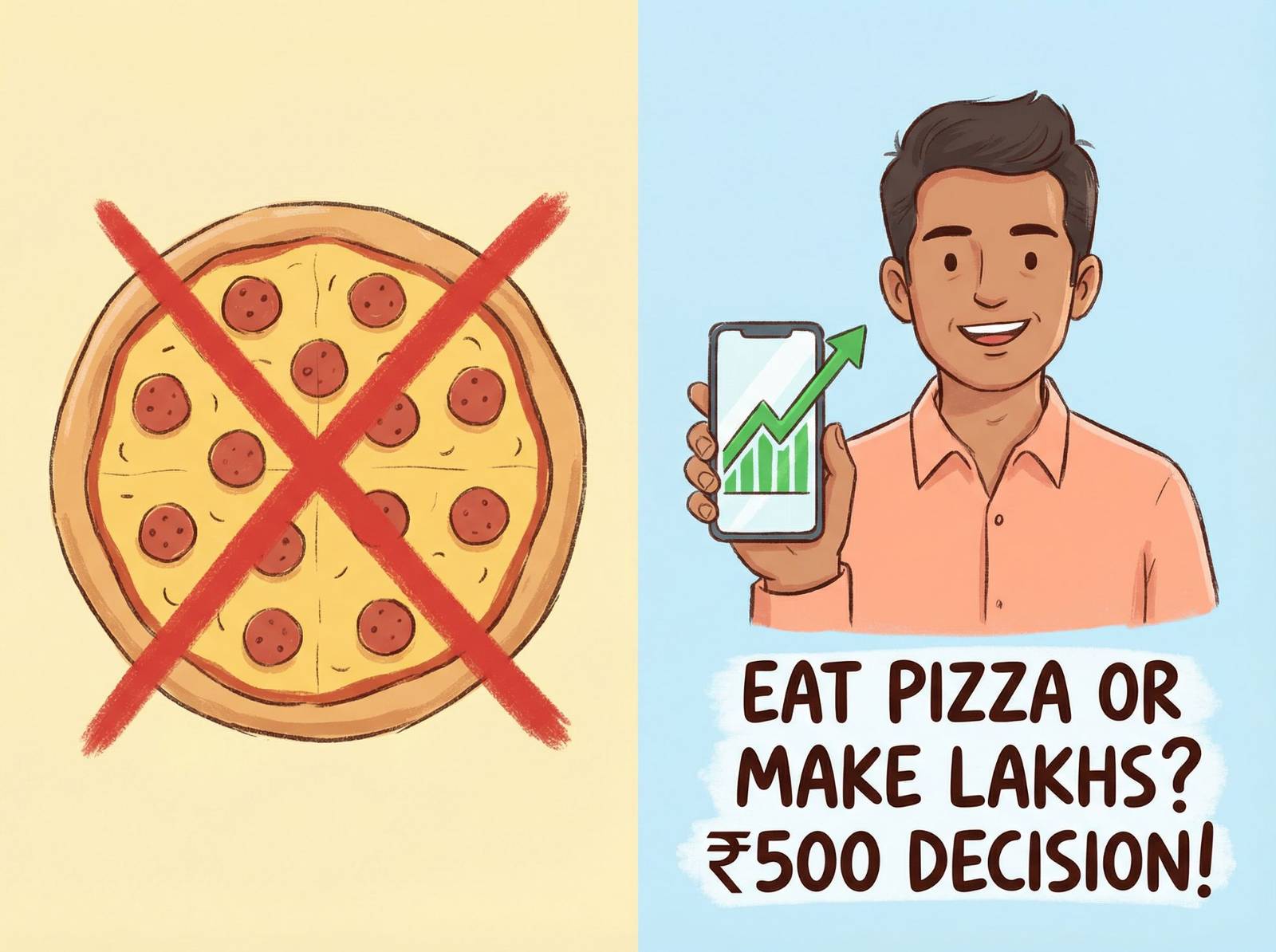

₹500 is what you likely spend on a Friday evening at a café in Indiranagar, or perhaps a single movie outing with popcorn in a Delhi multiplex. It is the cost of a mobile data recharge or a few plates of Biryani. In the grand scheme of your monthly budget, ₹500 often slips through the cracks, unaccounted for.

But what if I told you that this specific, overlooked purple note is the seed to your future financial freedom?

Many young Indians—especially college students and first-time jobbers—fall into a dangerous trap. They believe investing is a “rich people sport.” They think, “Let me earn 1 Lakh a month first, then I will talk to a CA.”

This is the biggest mistake you can make. You do not need a suit, a tie, or a fat bank balance. You just need the discipline to start SIP with 500 rupees.

Today, we are going to look at why starting small is actually smarter than waiting to start big. And to help us understand this, we need to visit our friend, Shankaran Pillai, down in Kallakurichi.

The Shankaran Pillai Perspective: Consistency Over Volume

Shankaran Pillai isn’t a stock market wizard. He runs a small printing shop near the bus stand in Kallakurichi, Tamil Nadu. He doesn’t watch business news channels where people scream about “Buy” and “Sell” targets.

Ten years ago, Shankaran Pillai made a simple decision. Every month, the moment he paid his shop’s electricity bill, he would transfer ₹500 into an equity mutual fund.

His neighbour, a young IT professional visiting from Chennai, laughed at him. “Anna, what will you get with ₹500? That’s peanut money. I wait until I have ₹50,000, and then I lump-sum invest during a market crash.”

Here is the twist. The IT professional kept waiting for the “perfect market crash” or spent his “surplus” on upgrading his iPhone. He rarely invested. Shankaran, however, never stopped. Rain, shine, demonetisation, or pandemic—Shankaran’s ₹500 left his account on the 5th of every month.

Today, Shankaran Pillai has a corpus that shocks his neighbours. Not because he put in crores, but because he gave his small money lots of time.

This is the essence of micro-investing India. It is not about how much you earn; it is about how much you keep aside before you start spending.

The Math: Growth of 500 Rupees SIP

Let’s put emotion aside and look at the cold, hard mathematics.

If you are 21 years old today, you have one asset that a 45-year-old billionaire does not have: Time.

Let’s assume you decide to start SIP with 500 rupees in a diversified equity mutual fund. Historically, Indian equity markets (NIFTY 50 or SENSEX) have delivered returns of around 12% to 15% over the long term.

Scenario 1: The “Coffee Sacrifice” (Static Investment)

- Monthly Investment: ₹500

- Duration: 30 Years

- Expected Return: 13% (Reasonable expectation for India)

- Total Money You Invested: ₹1.8 Lakhs

- Value of Investment: ₹21.5 Lakhs

Read that again. You put in less than ₹2 Lakhs over three decades (in tiny ₹500 chunks), and you walk away with over ₹21 Lakhs. That is the power of small investing.

Scenario 2: The “Smart Step-Up” (Real Wealth Creation)

Now, let’s be realistic. You won’t be earning the same salary in 10 years that you are earning today.

Shankaran Pillai follows a rule: Every year, increase the SIP amount by 10%.

- Year 1: ₹500/month

- Year 2: ₹550/month (Just ₹50 extra!)

- Year 3: ₹605/month

If you follow this Step-Up SIP method for 30 years @ 13%:

- Total Money Invested: ~₹10 Lakhs

- Value of Investment: ~₹68 Lakhs to ₹70 Lakhs

By sacrificing one movie ticket now, and marginally increasing that amount yearly, you could be sitting on nearly ₹70 Lakhs by the time you are 50. This is enough to fund a child’s higher education or a significant portion of a retirement kitty.

Why ₹500 is the Perfect Entry Barrier

You might be thinking, “But why not wait until I can invest ₹5,000?”

1. It Builds the Habit (Samskara)

In India, we value Samskara (habit/culture). Investing is a muscle. If you cannot discipline yourself to set aside ₹500 when you earn ₹20,000, you will definitely not set aside ₹5,000 when you earn ₹1 Lakh. Expenses have a funny way of expanding to fill your income. By locking in a minimum SIP investment now, you are wiring your brain to pay yourself first.

2. Rupee Cost Averaging (The Safety Net)

New investors are terrified of market volatility.

- “What if the market crashes tomorrow?”

- “What if the Sensex drops 2,000 points?”

When you do a SIP of ₹500, a market crash is actually good news for you.

- When the market is High (expensive), your ₹500 buys fewer units.

- When the market is Low (cheap), your ₹500 buys more units.

Over time, your average cost comes down. You stop worrying about timing the market and start enjoying the ride.

3. Liquidity for Emergencies

While you should aim for long-term growth, mutual funds are generally liquid. Unlike a PPF (locked for 15 years) or Real Estate (takes months to sell), if Shankaran Pillai has a medical emergency, he can redeem his units and get the money in his bank account within 2 to 3 working days.

Where Should You Put Your ₹500?

Disclaimer: I am not a SEBI registered advisor. This is for educational purposes. Always consult a financial advisor.

When looking for the best mutual funds for small SIP, keep it simple. You don’t need exotic sector funds or high-risk small caps right away.

- Index Funds: These simply copy the Top 50 companies in India (Nifty 50). If India grows, your money grows. Low risk relative to other equity funds, and very low fees.

- Flexi-Cap Funds: These allow the fund manager to invest in companies of all sizes—large giants like Reliance or TCS, and growing mid-sized companies.

- ELSS Funds: If you are earning taxable income, these funds save you tax under Section 80C and grow your wealth. However, they have a 3-year lock-in.

Overcoming the “Log Kya Kahenge” of Finance

In India, we have a status problem. We like to show off big purchases—a Royal Enfield, a DSLR, a new flat. No one brags about a ₹500 SIP.

Your friends might mock you. “Bro, you are investing ₹500? That’s what I tip the waiter!”

Let them laugh.

Remember the story of the hare and the tortoise? In the financial world, the hare is the guy buying crypto-currencies hoping to double his money in a week (and usually losing it). The tortoise is Shankaran Pillai with his ₹500 SIP.

The tortoise doesn’t just win; the tortoise owns the racecourse eventually.

How to Start (The 10-Minute Guide)

You do not need to visit a bank branch and drink ten cups of tea while filling out forms. You can do this from your mobile while lying on your sofa.

- Get Your Documents: Pan Card, Aadhar Card, and a Bank Account.

- Choose a Platform: Use apps like Zerodha Coin, Groww, Kuvera, or go directly to the AMC website (e.g., SBI Mutual Fund, HDFC Mutual Fund, Nippon India).

- Complete KYC: This is a one-time video call or Aadhaar OTP process. It takes 5 minutes.

- Select a Fund: Look for a “Growth” plan (not Dividend) and “Direct” plan (lower fees).

- Set Auto-Pay: This is critical. Automate the deduction. If you rely on manual transfer, you will forget, or you will spend the money on a sale on Myntra.

Conclusion: The Cost of Waiting

Every month you delay, you are not just losing ₹500. You are losing the compounding interest on that ₹500 for the next 30 years.

If you wait 5 years to start, you don’t just lose 5 years of savings; you might lose 10-15 Lakhs in the final corpus value because compounding works best at the very end of the cycle.

So, cancel one subscription you don’t use. Skip the extra cheese on the pizza. Walk instead of taking an auto for short distances. Find that ₹500.

Be like Shankaran Pillai. Start small, start boring, but start today.

Your future self will look back at this moment and say, “That was the best ₹500 I ever spent.”