What is the Best Date for SIP Deduction? 1st, 15th, or 25th?

Highlights

SIP Calculator

Introduction: The Hunt for the Perfect Muhurat

In India, we are obsessed with timing. We check the Rahukaalam before stepping out for a good deed, we wait for Akshaya Tritiya to buy gold, and we consult astrologers for wedding dates. It is only natural that when it comes to our hard-earned money, we want to know the absolute Best Date for SIP.

Let me introduce you to Shankaran Pillai from Kallakurichi, Tamil Nadu. Shankaran is a smart man. He works in a government office, earns a decent salary, and wants to build a corpus of ₹1 Crore for his daughter’s education.

Last month, Shankaran decided to start a SIP of ₹10,000. But he got stuck.

- “If I invest on the 1st, the market is high because everyone is buying.”

- “If I invest on the 25th, it’s near F&O expiry, so the market might be volatile.”

- “Maybe the 15th is the golden mean?”

He spent three weeks analysing charts, reading Telegram groups, and watching YouTube “gurus.” In the process, he missed an entire month of investing.

If you are like Shankaran Pillai, trying to squeeze an extra 0.5% return by picking the perfect date, this guide is for you. Let’s look at the data, the psychology, and the practical reality of Indian cash flow.

The Data: Does the Date Actually Matter?

Let’s put emotions aside and look at the cold, hard numbers.

Many analysts have run back-tests on the Nifty 50 index over the last 10, 15, and 20 years to see if a specific date yields higher returns.

Here is the reality:

Over a 10-year period, the difference in CAGR (Compound Annual Growth Rate) between the “best” date and the “worst” date is usually less than 0.3%.

To put this in perspective:

If Shankaran invests ₹10,000 monthly for 10 years:

- Invested on the 1st: Corpus might be approx ₹22.5 Lakhs.

- Invested on the 25th: Corpus might be approx ₹22.45 Lakhs.

- Invested on the 15th: Corpus might be approx ₹22.48 Lakhs.

The difference is roughly the cost of a few family dinners at a nice restaurant. Is it worth stressing over every month? Absolutely not.

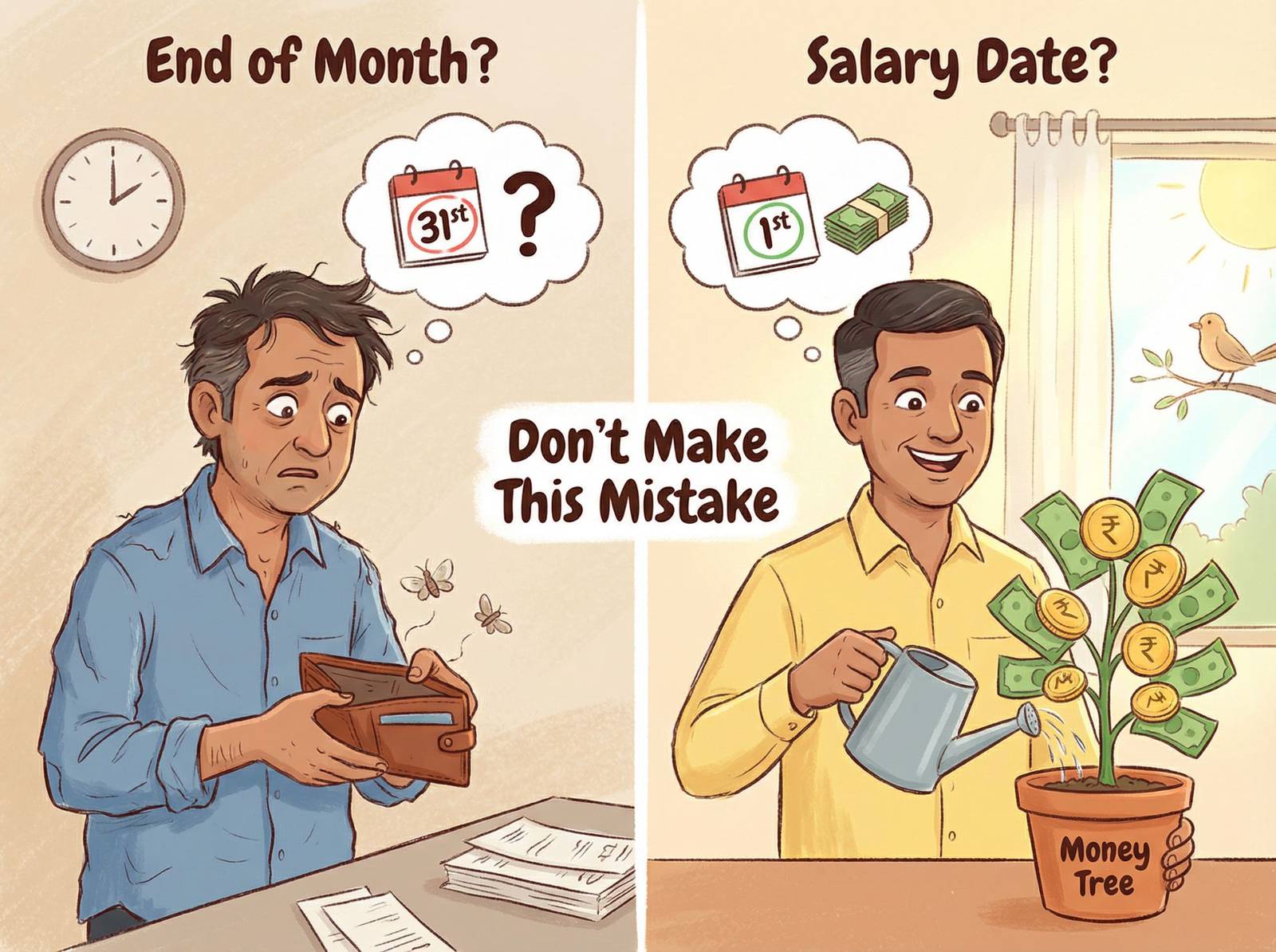

The “Start of Month” vs. “End of Month” Debate

There is a popular theory that markets are bullish at the start of the month (due to salary inflows) and bearish at the end (due to profit booking). While this pattern appears occasionally, it is not consistent enough to build a strategy around. In the long run, the Indian market moves based on earnings and economy, not the calendar date.

The Real Danger: The “Insufficient Funds” Trap

While the market doesn’t care about the date, your bank balance definitely does.

Let’s go back to Shankaran Pillai.

Shankaran gets his salary credited on the 1st of every month.

He decides, based on some technical analysis, that the 25th is the Best Date for SIP.

Here is the timeline of Shankaran’s disastrous month:

- 1st: Salary credited (₹60,000). Feeling rich!

- 5th: Pays House Rent and Electricity bill.

- 10th: Buy groceries and pays the credit card bill.

- 14th: His bike breaks down. Repairs cost ₹4,000.

- 18th: A cousin’s wedding in Madurai. Need to buy a gift and bus tickets. Cost: ₹5,000.

- 22nd: Goes out for a movie and dinner with the family.

- 25th (SIP Date): The bank attempts to deduct ₹10,000.

- Balance in Account: ₹6,500.

- Result: Transaction Failed.

The Consequences:

- Bank Penalty: Most banks in India charge between ₹300 to ₹750 for a SIP bounce (ECS return charge).

- AMC Rejection: Some Mutual Fund houses may reject future SIPs if bounces happen frequently.

- Missed Compounding: He didn’t invest that month.

If Shankaran had set the date for the 3rd or 4th, the money would have been invested before the bike broke down or the cousin got married.

The Golden Rule: Salary Date + 2 Days

For 99% of salaried Indians, the answer to “What is the Best Date for SIP?” is simple:

Your Salary Credit Date + 2 Days.

Why 2 days? Why not the same day?

Sometimes, salary processing gets delayed due to bank holidays or weekends. If payday is the 1st, and the 1st is a Sunday, you might get the money on the 2nd. If your SIP hits on the 1st, it bounces. Giving a 2-day buffer ensures the funds are definitely available.

The “Pay Yourself First” Philosophy

This is the most crucial habit for wealth creation.

If you wait until the end of the month to invest what is left, you will usually find that nothing is left. Expenses in an Indian household expand to fill the available income.

- Did you really need that extra pair of shoes?

- Did you need to order biryani three times this week?

If the SIP is deducted on the 3rd, you are forced to manage the rest of the month with the remaining amount. You adjust your lifestyle to your savings, rather than adjusting your savings to your lifestyle.

Scenario Analysis: Which Date Suits You?

While I recommend the “Salary + 2 Days” rule, here is a breakdown for different types of people.

1. The Salaried Employee (The Shankaran Pillai)

- Income Frequency: Monthly (Fixed Date).

- Best Date: 3rd to 5th of the month.

- Reason: High liquidity. Mental peace that investment is done for the month.

2. The Businessman / Freelancer

- Income Frequency: Irregular/Variable.

- Best Date: Multiple dates or Weekly SIPs.

- Reason: Since you don’t know when a client will pay, splitting a ₹20,000 monthly SIP into four weekly SIPs of ₹5,000 reduces the risk of a bounce.

3. The “Tactical” Investor (Niche)

- Strategy: Trying to capture volatility.

- Best Date: Last Thursday of the month (F&O Expiry).

- Reason: Markets can be volatile on expiry days. However, this is high effort for low reward. Not recommended for passive investors.

Common Myths Busted

Myth 1: “Investing at the end of the month captures the dips.”

Fact: Sometimes the market rallies at the end of the month. If the market goes up 4% between the 1st and the 30th, you just bought units at a higher price by waiting.

Myth 2: “Daily SIPs are better than Monthly SIPs.”

Fact: Daily SIPs create a lot of clutter in your bank statement and tax filing (capital gains calculations) without offering significant returns over monthly SIPs. Stick to monthly for simplicity.

Myth 3: “I should stop SIP when the market is falling.”

Fact: That is actually the best time for your SIP to hit. You get more units for the same price. Never stop the SIP during a market correction.

Conclusion: What did Shankaran Pillai Finally Do?

After missing one month of investing and almost paying a bounce charge the next month, Shankaran Pillai stopped looking at the charts.

He walked into his bank (or rather, logged into his app) and set his SIP date for the 5th of every month. His salary comes on the 1st.

- By the 5th, the ₹10,000 is gone into the Nifty 50 Index Fund.

- He runs his household with the remaining balance.

- He doesn’t care if the market is up or down on the 5th.

Five years later, Shankaran doesn’t remember the “market levels” of 2024. He just sees that his corpus has grown significantly because he was disciplined, not because he was lucky.

Final Verdict:

Don’t over-optimise. The Best Date for SIP is the date when your bank account has money. For most of us, that is right after payday.

FAQ: Your Questions Answered

Q1: Can I change my SIP date later?

Yes, most AMC apps (like Zerodha Coin, Groww, or CAMS) allow you to modify the SIP date. However, it might take 15-30 days to reflect.

Q2: What if my SIP date falls on a Sunday or Public Holiday?

The transaction will be processed on the next working business day. You don’t need to worry; the Net Asset Value (NAV) of the next business day will apply.

Q3: Is it better to split my SIP into two dates (e.g., 5th and 20th)?

This is a good strategy if you are investing a large amount (e.g., ₹50,000+). It averages out the cost slightly better. For smaller amounts, a single date is fine.