Step Up SIP benefits: Boost Your Wealth with Your Yearly Appraisal

Highlights

SIP Calculator

Every year, around March or April, a familiar buzz takes over offices across India—from the tech parks of Bengaluru to the corporate towers of Gurgaon. It is Appraisal Season.

The moment that “Salary Revision Letter” hits the inbox, the mental calculations begin.

“Arey, 15% hike! Now I can finally book that trip to Ladakh.”

“EMI for the new car will be covered easily now.”

But before you upgrade your lifestyle, I want you to pause. We often talk about the “Magic of Compounding,” but there is a turbo-charger to this engine that most Indian investors ignore. It is called the Step Up SIP (or Top-up SIP).

Let me introduce you to Shankaran Pillai from Kallakurichi to explain why this strategy is critical for your financial health.

The Tale of Two Investors: Shankaran Pillai vs. The Smart Neighbor

Shankaran Pillai works as a Senior Manager in a logistics firm. He is a disciplined man. He drinks his filter coffee at 6:30 AM sharp, reads the newspaper, and believes in saving for a rainy day.

Ten years ago, Shankaran started a SIP (Systematic Investment Plan) of ₹10,000 per month in a good Equity Mutual Fund. He set it and forgot it.

His neighbor, let’s call him Ramesh, also started a SIP of ₹10,000 per month in the same fund at the same time.

But Ramesh did something different. Every time he got his yearly appraisal, he increased his SIP amount by just 10%.

- Year 1: ₹10,000/month

- Year 2: ₹11,000/month

- Year 3: ₹12,100/month

Shankaran laughed at Ramesh. “Why take the headache of changing the bank mandate every year? 10% is hardly anything. It won’t make a big difference.”

Was Shankaran right? Let’s look at the numbers.

The Shocking Comparison Table

Assuming both their funds generated an average return of 12% per annum over 20 years:

| Parameter | Shankaran Pillai (Fixed SIP) | Ramesh (10% Step Up SIP) |

| Monthly Start | ₹10,000 | ₹10,000 |

| Annual Increase | 0% | 10% |

| Duration | 20 Years | 20 Years |

| Total Amount You Invested | ₹24 Lakhs | ₹68.7 Lakhs |

| Wealth Created (Final Value) | ₹99.9 Lakhs (~1 Cr) | ₹2.35 Crores |

| The Difference | + ₹1.35 Crores Extra |

Note: Calculations are approximate for illustration purposes.

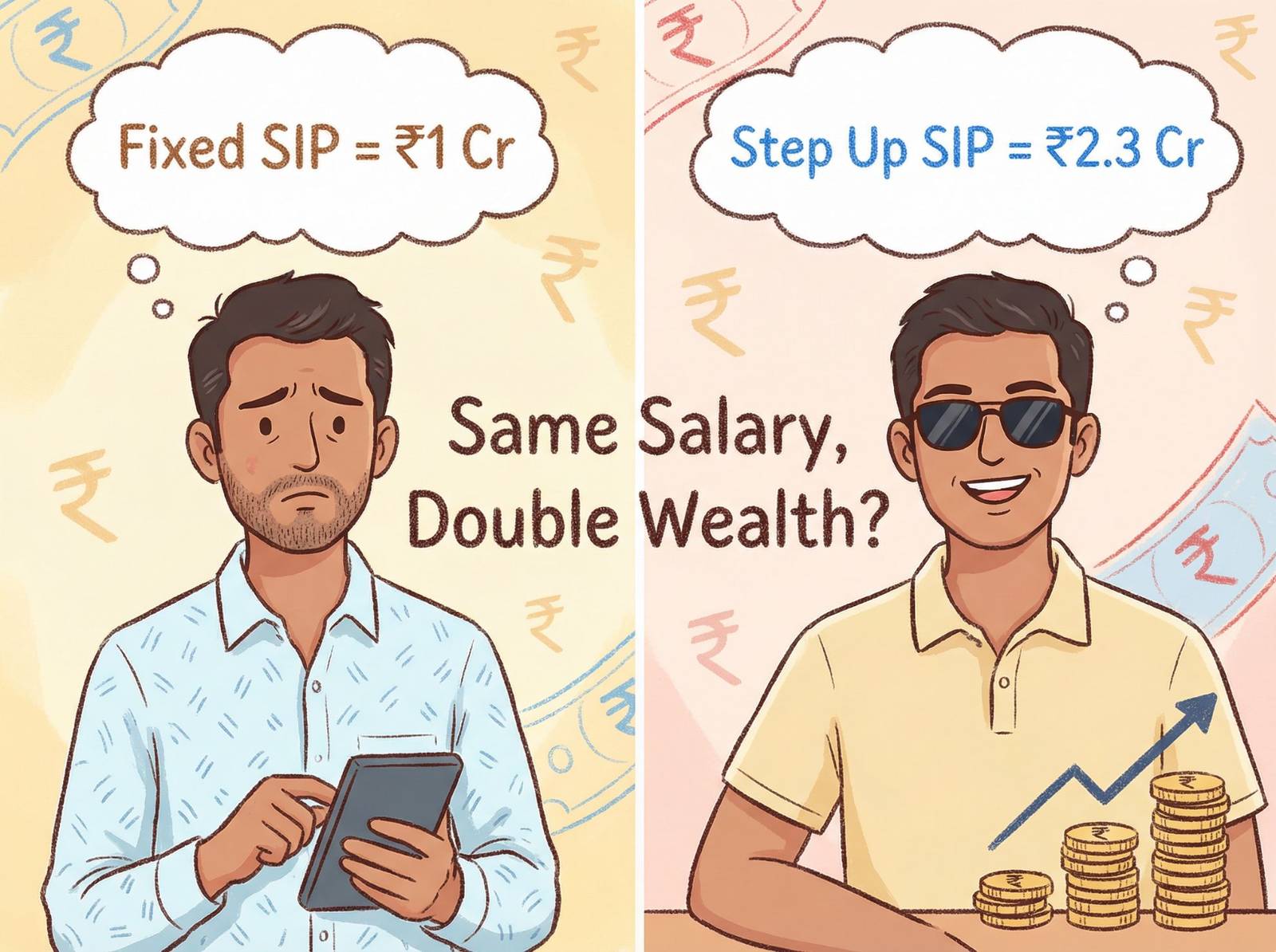

Look at that difference. Shankaran retires with ₹1 Crore. Ramesh retires with ₹2.35 Crores.

Ramesh has more than double the wealth of Shankaran Pillai, simply by committing a small slice of his yearly salary hike to his future self. This is the core of the Step Up SIP benefits.

Why Step Up SIP is Non-Negotiable in India

1. Beating the “Lifestyle Inflation” Trap

In India, our expenses tend to grow faster than our savings. The moment we get a promotion, we move from a split AC to a central AC, or from a hatchback to a sedan. This is called lifestyle creep.

By automating a salary hike investment into a Step Up SIP, you pay yourself first. You won’t miss that extra money because you never got used to spending it.

2. The Inflation Monster

A liter of milk in 2010 cost roughly ₹30. Today, it is touching ₹60+. Education costs in India are rising at 10-12% annually. A fixed SIP of ₹10,000 might look big today, but in 15 years, its purchasing power will be equivalent to just ₹4,000 or ₹5,000.

Increasing SIP every year ensures your investment keeps pace with the rising cost of living in Tier-1 and Tier-2 cities.

3. Reaching Goals Faster

Shankaran Pillai wants to buy a plot of land in his hometown, Kallakurichi. With a fixed SIP, he might have to wait 20 years.

With a Top-up SIP, he utilizes the power of the SIP booster calculator logic—putting more money to work when the compounding snowball is biggest (in the later years). He might reach his target corpus in 15 years instead of 20.

How to Calculate Your Step Up Strategy

You don’t need complex Excel sheets. The rule of thumb is simple:

- Conservative: Increase SIP by 5% annually.

- Moderate (Recommended): Increase SIP by 10% annually.

- Aggressive: Increase SIP by the exact percentage of your salary hike. (If you get a 15% hike, increase SIP by 15%).

Let’s be realistic. If you are earning ₹80,000 a month and investing ₹15,000, and you get a ₹10,000 hike:

- Option A: Spend the whole ₹10,000 on a new iPhone EMI.

- Option B: Invest ₹5,000 (Step Up) and enjoy the remaining ₹5,000.

Option B allows you to enjoy your success today and secure your tomorrow.

Practical Steps: How to Enable Step Up SIP

Most Indian investment platforms have made this incredibly easy. You don’t need to visit the bank or fill out physical forms like the old days.

- For New SIPs: When starting a SIP on apps like Zerodha Coin, Groww, or direct AMC websites, look for a checkbox that says “Step-up” or “Top-up Cap.” You can define the percentage (e.g., 10%) or a fixed amount (e.g., ₹1,000) yearly.

- For Existing SIPs: You usually cannot modify an existing live SIP mandate. You simply start a new separate SIP for the incremental amount.

- Example: Shankaran has a ₹10k SIP running. He gets a hike. He starts a new SIP of ₹1,000 in the same fund. Total investment = ₹11k.

Common Pitfalls to Avoid

Even a smart man like Shankaran Pillai can make mistakes if he isn’t careful. Here is what you must avoid:

- Stopping the SIP when markets fall: If the market dips, do not stop your Step Up. In fact, your increased amount buys more units at a lower price (Rupee Cost Averaging).

- Over-committing: Don’t set a 20% step-up if your salary only grows by 8%. You will run out of cash flow and end up cancelling the SIP, which attracts penalties or breaks discipline.

- Ignoring the “Cap”: Some platforms allow you to set a “Max Cap.” If you Step Up indefinitely, the amount might become higher than your salary in 30 years! Set a realistic ceiling (e.g., maximum ₹1 Lakh per month).

Final Thoughts from Shankaran Pillai

Shankaran eventually realized his mistake. He saw that while he was busy bargaining for ₹10 savings on vegetables at the local market, he was losing Lakhs by keeping his investments stagnant.

This appraisal season, don’t just upgrade your phone. Upgrade your wealth.

The Step Up SIP benefits are not just about more money; they are about freedom. Freedom to retire early, freedom to fund your child’s education without a loan, and freedom from financial anxiety.

Pro Tip: If your appraisal is due next month, log into your investment app today and set a reminder. Future You will thank you.