SIP vs Mutual Fund: What is the Difference? (2026 Beginner Guide)

Highlights

Introduction: The “Coffee Shop” Confusion

Shankaran Pillai is at a wedding reception. He is talking to his nephew, a finance graduate.

“Thambi,” Shankaran says proudly, “I have invested in two things. I put ₹5,000 in HDFC Mutual Fund, and I put ₹5,000 in a SIP.”

His nephew tries not to laugh. “Uncle,” he says, “That is like saying you bought a Maruti Car and you also bought a Loan. You can’t drive a Loan!”

Shankaran is confused. If you are too, don’t worry. In India, the terms “SIP” and “Mutual Fund” are used so interchangeably that most people think they are two different assets.

They are not. Let’s clear this up once and for all.

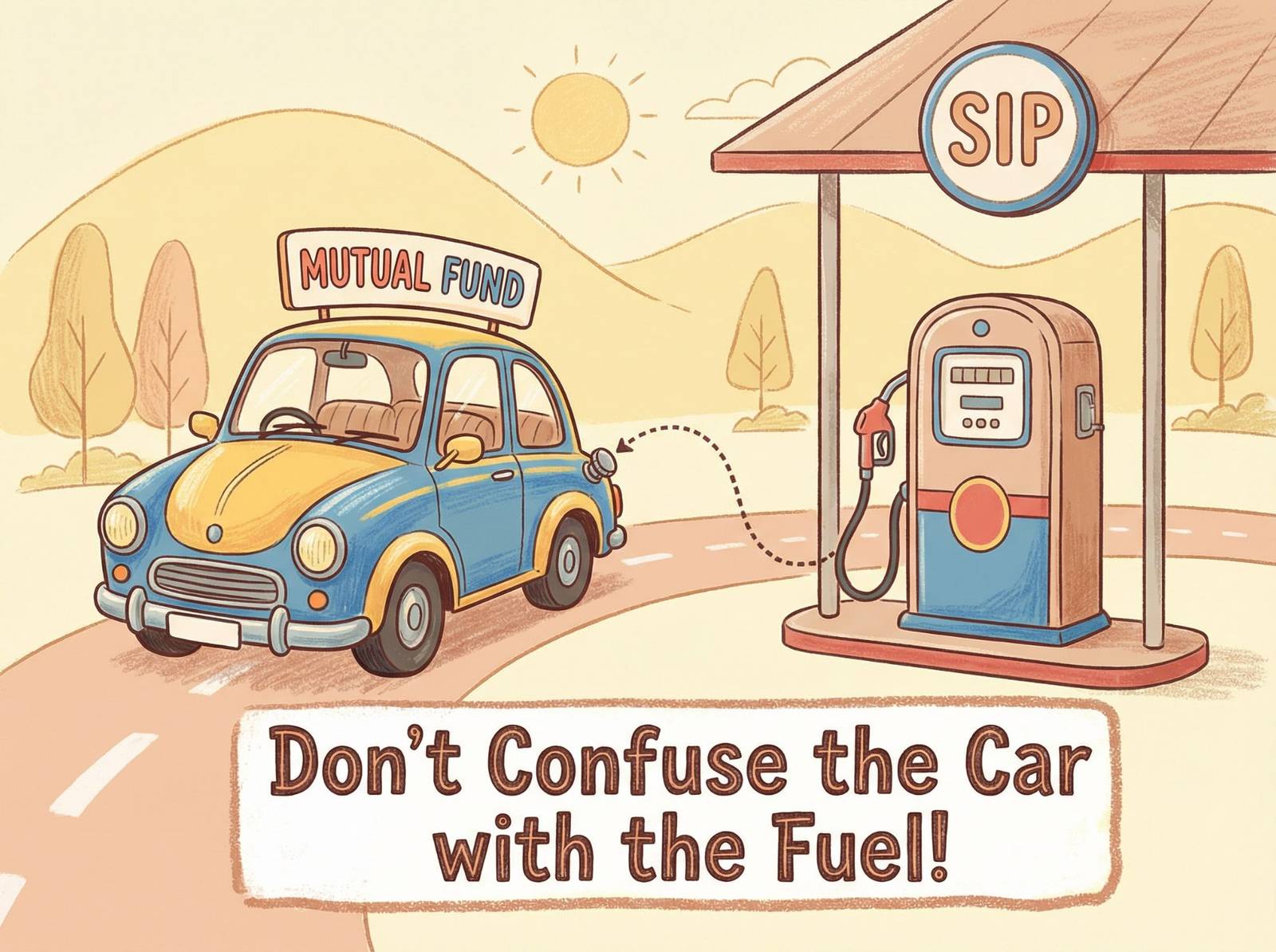

The Core Difference: Product vs. Method

Here is the simplest way to understand it:

- Mutual Fund is the Product. (The thing you are buying).

- SIP (Systematic Investment Plan) is the Method. (The way you are paying for it).

Think of it like a Gym Membership:

- The Gym (Mutual Fund): This is the place where you build muscle (Wealth).

- Annual Fee (Lumpsum): You pay for the whole year at once.

- Monthly Fee (SIP): You pay a small amount every month automatically.

In both cases, you are going to the same gym. You are just paying differently.

The Ultimate Guide to SIP Investment in India

What is a Mutual Fund? (The Vehicle)

A Mutual Fund is a pool of money collected from many investors (like you, Shankaran, and millions of others).

A professional Fund Manager takes this huge pool of money and invests it in:

- Stocks (Equity Funds) – High risk, High return.

- Bonds (Debt Funds) – Low risk, Stable return.

- Gold – Hedge against inflation.

When you invest, you are buying “Units” of this fund. The value of these units (NAV) goes up or down based on the market.

What is a SIP? (The Mode of Payment)

SIP stands for Systematic Investment Plan.

It is a tool that allows you to invest small amounts fixedly (e.g., ₹500 or ₹1,000) at regular intervals (usually monthly) into that Mutual Fund.

Why is it popular?

- Convenience: The money is cut from your bank automatically.

- Affordability: You don’t need ₹1 Lakh to start. You just need ₹500.

- Discipline: It forces you to save before you spend.

The Real Battle: SIP vs. Lumpsum

Since “SIP vs. Mutual Fund” is grammatically wrong, the actual decision Shankaran needs to make is: “Should I invest via SIP or Lumpsum?”

Here is the comparison:

| Feature | SIP (Systematic Investment Plan) | Lumpsum (One-Time Investment) |

| What is it? | Investing small amounts regularly (e.g., monthly). | Investing a large amount all at once. |

| Best For | Salaried people (Monthly income). | People with a bonus, property sale, or inheritance. |

| Market Timing | Not Required. Buying at all levels averages the cost. | Critical. Investing a lump sum at a market peak is risky. |

| Risk | Lower (due to Rupee Cost Averaging). | Higher (if the market crashes immediately after). |

| Psychology | Easy to stick with during market crashes. | Panic-inducing during crashes. |

Shankaran’s Scenario:

- If Shankaran gets his monthly salary ➝ Choose SIP.

- If Shankaran retires and gets a Gratuity check of ₹20 Lakhs ➝ Choose Lumpsum (but invest it wisely via STP – Systematic Transfer Plan).

How to Use a SIP Calculator to Plan Your ₹1 Crore Goal

Why Shankaran Should Choose SIP (The “Rupee Cost Averaging” Magic)

Let’s say Shankaran buys Apples (Mutual Fund Units).

- Month 1: Apples are ₹100/kg. He buys 1 kg.

- Month 2: Apples are expensive (₹200/kg). He buys 0.5 kg.

- Month 3: Apples are cheap (₹50/kg). He buys 2 kgs.

Result: He bought more apples when they were cheap and fewer when they were expensive. His average cost is lower than the market price. This is exactly how SIP works with Mutual Fund units.

If he had used Lumpsum in Month 2, he would have bought everything at the most expensive price!

Conclusion: You Don’t Have to Choose!

So, the answer to “SIP vs. Mutual Fund” is simple: You need both.

You cannot have a SIP without a Mutual Fund, and a Mutual Fund is hardest to buy without a SIP (unless you are rich).

Final Advice for Shankaran:

- Select a Mutual Fund (e.g., a Nifty 50 Index Fund).

- Start a SIP in that fund (e.g., ₹5,000/month).

- Sit back and let the compounding happen.

Ready to start your journey?