Should You Stop SIP in market crash? The Cost of Panicking

Highlights

SIP Calculator

It’s 9:30 AM. You open your phone, tap on your mutual fund app (maybe Groww, Zerodha, or your bank’s app), and your heart sinks. Everything is red. The Nifty is down by 2%, and your portfolio, which was looking healthy last month, has wiped out six months of gains.

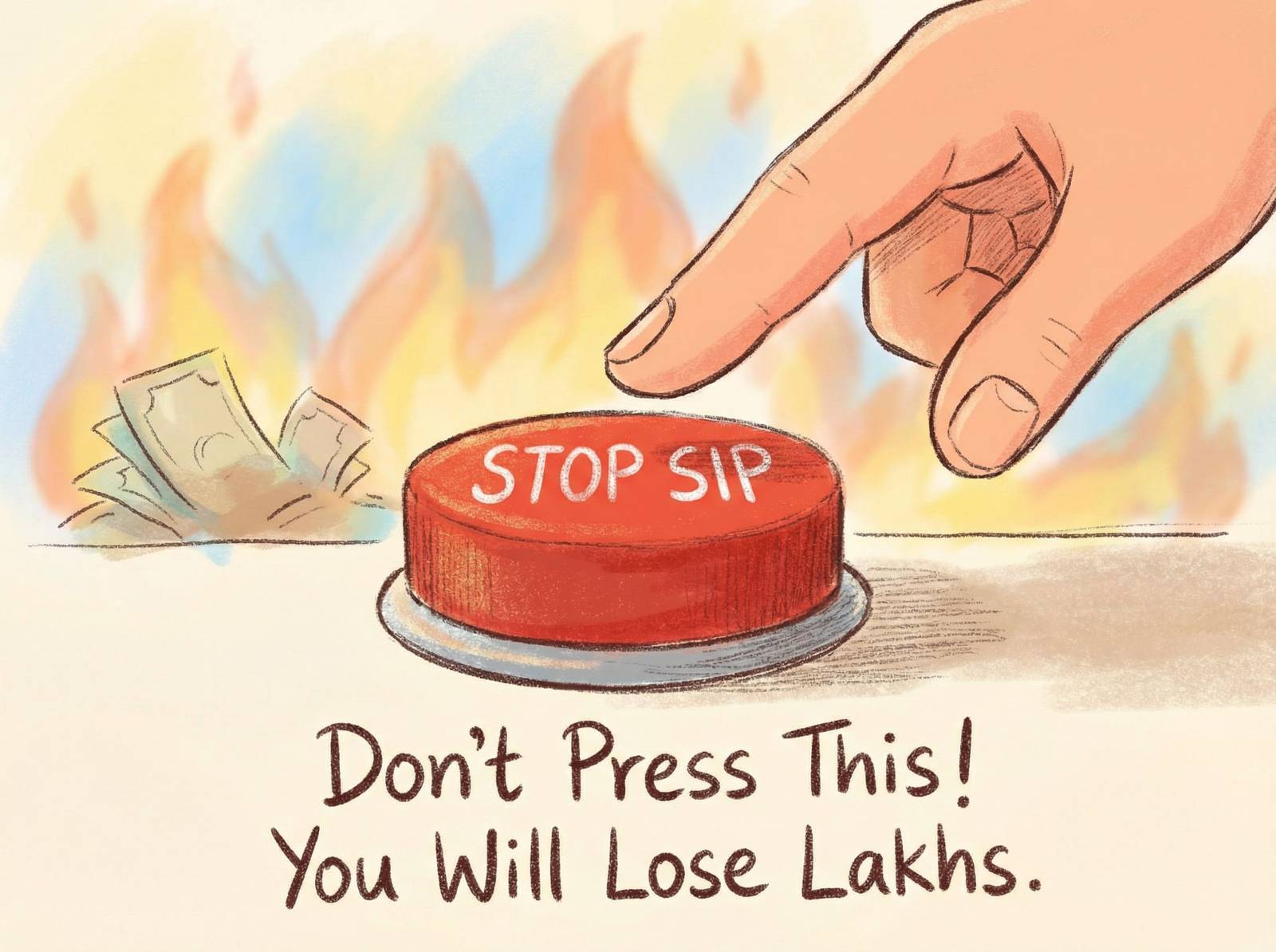

Your finger hovers over the “Pause SIP” or “Cancel Mandate” button. You think, “Let me stop now, save my money, and I’ll start again when the market settles down.”

Stop right there.

Shankaran Pillai, our friend from Kallakurichi, Tamil Nadu, had the exact same thought yesterday. He called me in a panic. “Ayyo, the market is bleeding! My ₹5 Lakh portfolio is now ₹4.6 Lakhs. Should I stop my monthly ₹10,000 SIP? Why throw good money after bad?”

If you are thinking like Shankaran, you are about to make a classic error. Deciding to stop SIP in market crash scenarios is not a safety measure; it is wealth destruction. Here is why.

The Vegetable Market Logic (Rupee Cost Averaging)

Let’s step away from the confusing charts and talk about something Shankaran Pillai understands very well: Onions.

Imagine Shankaran goes to the weekly santhe (market) to buy onions for his family. He has a fixed budget of ₹100 per week for onions.

- Scenario A: Onions are expensive (₹50/kg).

- Shankaran pays ₹100.

- He gets 2 kgs.

- Scenario B: There is a bumper harvest, and prices crash (₹20/kg).

- Shankaran pays ₹100.

- He gets 5 kgs.

When the price crashed, Shankaran didn’t run away screaming, “Oh no! Onions are cheap! I shouldn’t buy them!” No. He was happy because he got more quantity for the same money.

This is exactly how your SIP works.

In mutual funds, you buy “Units” (like kgs of onions). When the market is booming (Bull Market), the NAV (price per unit) is high. Your ₹10,000 SIP buys fewer units.

But when the market crashes (Bear Market), the NAV drops. Your same ₹10,000 buys more units. This is called Rupee Cost Averaging.

If you stop SIP in market crash, you are essentially refusing to buy onions when they are ₹20/kg, insisting that you will only buy them when they go back up to ₹50/kg. Does that make financial sense? Absolutely not.

The “Sale” Mentality vs. The “Crash” Mentality

Indians love a good bargain. Whether it is the Great Indian Festival sale on Amazon or bargaining at Sarojini Nagar or T. Nagar, we love getting value for money.

- When a fridge worth ₹40,000 drops to ₹30,000 during a sale, we rush to buy it.

- When a mutual fund NAV drops from ₹100 to ₹80, we rush to sell it or stop buying.

Why this double standard?

When you see “mutual fund negative returns,” you are seeing a notional loss (paper loss). You haven’t actually lost money unless you sell. By continuing your SIP, you are lowering your average cost of buying.

Shankaran’s Example:

- Month 1 (Market High): Shankaran buys 100 units at ₹50. Total spent: ₹5,000.

- Month 2 (Market Crash): NAV drops to ₹25. Shankaran continues SIP. He gets 200 units for ₹5,000.

- Total: He owns 300 units. Total spent ₹10,000.

- Average Cost: ₹33.33 per unit.

If the market recovers just a little bit to ₹35 (still far below the original ₹50), Shankaran is already in profit! If he had stopped his SIP in Month 2, he would be sitting with high-cost units, waiting forever to break even.

The Cost of Panicking: A History Lesson

Let’s look at real data, not just theory.

Think back to March 2020. COVID-19 hit, and the Sensex fell off a cliff. It dropped nearly 40% in weeks.

- Investor A (The Panicker): Stopped his SIP in March 2020 out of fear. He waited for “certainty.” He restarted in November 2020 when the market was “safe” (and expensive) again.

- Investor B ( The Disciplined): Kept his SIP running. He bought the dip automatically every month.

By 2021, the markets had bounced back ferociously. Investor B had accumulated a massive number of units at rock-bottom prices. His returns were significantly higher than Investor A, who missed the entire accumulation phase.

SIP recovery time is often faster than we expect. The Indian economy is resilient. Bear markets are historically shorter than bull markets. If you exit now, you turn a temporary dip into a permanent loss.

When Should You Actually Stop?

Is there ever a good reason to stop? Yes, but “market volatility” isn’t one of them.

You should only pause or stop if:

- Financial Emergency: You lost your job or have a medical crisis and strictly need the cash flow.

- Goal Achieved: You were investing for your daughter’s wedding, and the wedding is 6 months away. In this case, you should move money to a liquid fund, regardless of market conditions.

- Bad Fund Performance: The specific fund is underperforming its peers consistently for 2-3 years (not because the whole market is down, but because the fund manager is doing a bad job).

3 Steps for the Anxious Investor

If looking at your portfolio makes your blood pressure rise, here is a survival guide:

1. Delete the App (Temporarily)

If you are investing for 10 or 15 years, why are you checking the price today? It is like checking the price of your house every day. It doesn’t matter. If the volatility stresses you out, remove the shortcut from your home screen.

2. Increase Your SIP (If you have cash)

This is the “Pro Move.” If you have an extra ₹50,000 lying in a savings account earning a pathetic 3% interest, this is the time to do a “Lumpsum” top-up or increase your SIP amount. You are getting the units at a discount.

3. Zoom Out

Look at the Sensex chart for the last 20 years. There were crashes in 2000, 2008, 2016, and 2020. The line looks like a jagged saw, but the direction is always Up and to the Right.

Conclusion

Shankaran Pillai sat down, drank a strong filter coffee, and did the math. He realized that if he stopped his SIP now, he would be punishing himself for the market’s mood swings. He decided not only to continue his ₹10,000 SIP but to add an extra ₹5,000 this month to “buy the dip.”

The market will go up, and the market will go down. That is its nature. Your job is not to predict the weather, but to stay on the ship.

Do not let fear hijack your financial future. The next time you feel the urge to stop SIP in market crash, remember the onions. Buy more when it’s cheap, and thank yourself five years later.