How to Use a SIP to reach 1 Crore: A Realistic Timeline

Highlights

SIP Calculator

Introduction

In Kallakurichi, my neighbour Shankaran Pillai often debates with his son, Arun. Arun just landed his first IT job in Chennai. Shankaran believes in buying gold or land to build wealth. Arun, however, wants to become a “Crorepati” using his phone and a SIP (Systematic Investment Plan).

Shankaran laughs, “How can small monthly payments make you a Crorepati?”

This is a common question across India. Whether you are sipping tea in a Mumbai high-rise or calculating expenses in a Tier-2 city, the dream of ₹1 Crore is universal. But is it realistic?

Yes, it is. If Arun starts today, the math is shockingly in his favour. If he waits until he is his father’s age, the hill becomes a mountain.

Here is your realistic guide on using a SIP to reach 1 Crore.

How much monthly SIP is required to reach 1 Crore?

To reach ₹1 Crore in 20 years at an expected return of 12%, you need to invest approximately ₹10,000 per month.

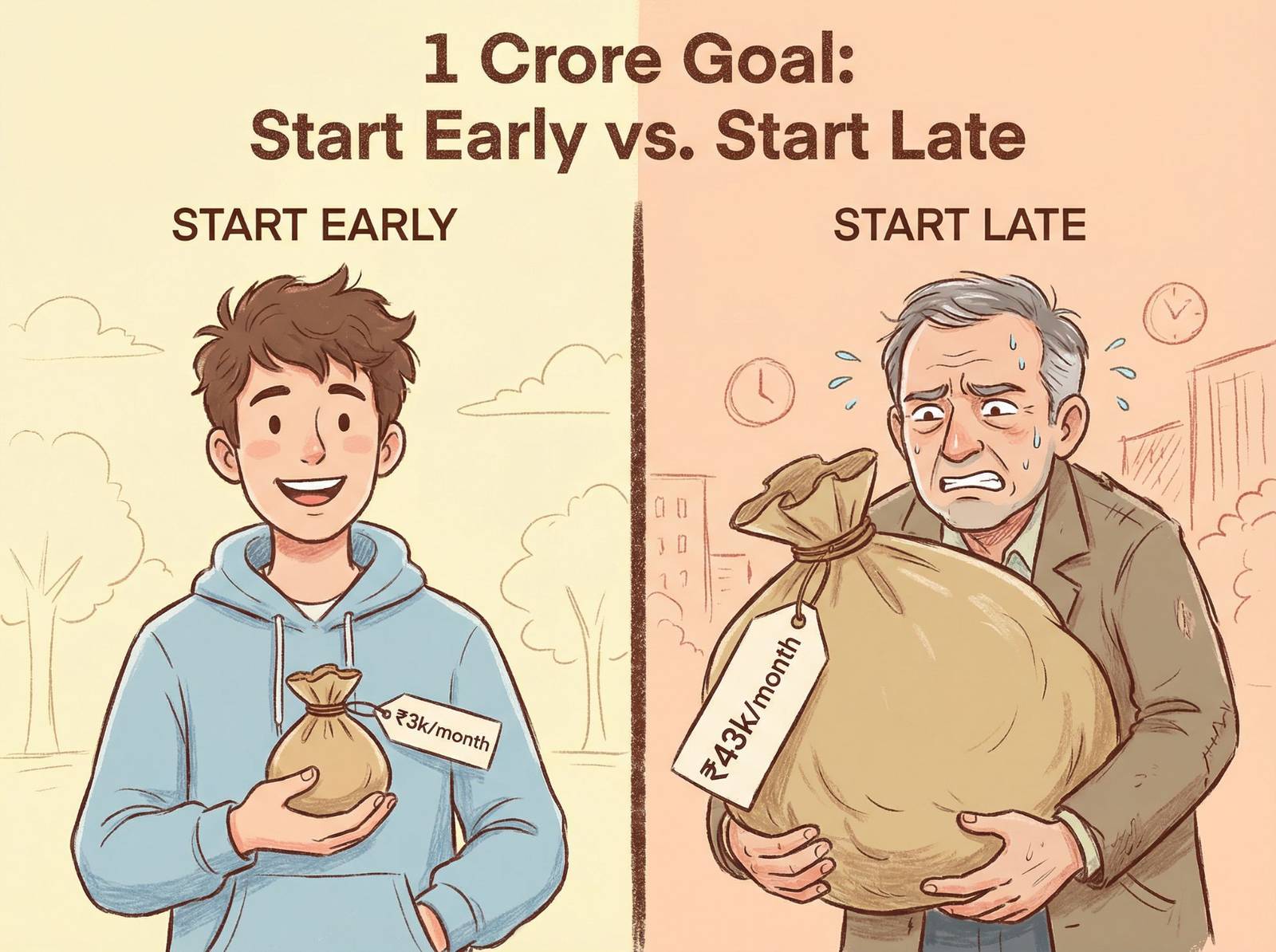

However, this number changes drastically based on how much time you have. Time is the most expensive ingredient in wealth creation. If you delay, the cost of delay is heavy in Lakhs.

The “Cost of Delay” Table (Assuming 12% Returns)

| Time Period | Monthly SIP Required | Total Money Invested by You | Interest Earned |

| 30 Years (Start at 25) | ₹2,861 | ₹10.3 Lakhs | ₹89.7 Lakhs |

| 20 Years (Start at 35) | ₹10,019 | ₹24 Lakhs | ₹76 Lakhs |

| 15 Years (Start at 40) | ₹20,017 | ₹36 Lakhs | ₹64 Lakhs |

| 10 Years (Start at 45) | ₹43,041 | ₹51.6 Lakhs | ₹48.4 Lakhs |

[Source: Standard Compound Interest Formula]

As you can see, Arun (age 25) only needs to put aside the cost of a weekend dinner (~₹2,800) to hit his goal by retirement. Shankaran (age 45) would need to invest nearly half his salary (~₹43,000) to hit the same target.

Why is “Time” more important than “Money”?

Compounding works best when you give it a long runway. This is often called the “Eighth Wonder of the World,” but let’s look at it simply.

When Arun invests for 30 years, his own money contributed is only ₹10.3 Lakhs. The remaining ₹89.7 Lakhs is pure interest generated by the market.

When Shankaran invests for only 10 years, he has to contribute ₹51.6 Lakhs from his own pocket to reach the same ₹1 Crore.

Key Takeaway: You do not need a high salary to be rich; you just need to start early.

Can I reach 1 Crore faster with a Step-Up SIP?

Yes, increasing your SIP amount annually (Step-Up SIP) is the fastest way to accelerate wealth creation.

Most young professionals in India get an annual appraisal or salary hike. If you increase your SIP monthly investment required by just 10% every year, you can reach your goal much faster or with a smaller starting amount.

Scenario: Reaching ₹1 Crore in 15 Years (12% Return)

- Standard SIP: You need to invest ₹20,000/month constant.

- 10% Step-Up SIP: You start with ₹11,500/month and increase it by 10% yearly.

For a young earner, finding ₹11,500 is much easier than finding ₹20,000. This strategy aligns your investment with your career growth.

Strategies for Different Age Groups

To make this practical, let’s look at how different people in Shankaran Pillai’s circle should approach this.

1. The Fresher (Age 22-25)

- Goal: Wealth Accumulation.

- Strategy: Aggressive. You have time.

- Asset Allocation: 90% Equity Mutual Funds (Mid-cap/Small-cap), 10% Debt.

- Shankaran’s Advice: “Don’t spend it all on gadgets.” Start a SIP of ₹3,000 immediately.

2. The Family Man/Woman (Age 30-35)

- Goal: Becoming a crorepati in 15 years.

- Strategy: Balanced but growth-oriented.

- Asset Allocation: 70% Equity (Flexi-cap/Large-cap), 30% Debt/Gold.

- Focus: Use a 1 crore corpus calculator to adjust for inflation. ₹1 Crore today will not have the same value in 15 years. Aim for ₹1.5 Crore.

3. The Late Starter (Age 40-45)

- Goal: Retirement Security.

- Strategy: Conservative Growth.

- Asset Allocation: 60% Large-cap Equity, 40% Debt.

- Focus: Maximize savings. Cut unnecessary expenses. You cannot afford risky small-cap funds as you don’t have time to recover from a market crash.

Common Mistakes That Kill the 1 Crore Dream

Even with a perfect mutual fund calculator for 1 crore, people fail. Why? Psychology.

1. Stopping SIPs during a Market Crash

When the market falls, Shankaran Pillai usually calls Arun in a panic: “The market is down! Withdraw everything!” This is the worst mistake. When the market is down, you get more units for the same price. Stopping a SIP breaks the compounding chain.

2. Ignoring Inflation

₹1 Crore sounds like a lot today. In 20 years, with 6% inflation, its purchasing power will be roughly ₹30 Lakhs.

- Solution: Don’t stop at ₹1 Crore. As your salary grows, increase your target.

3. Withdrawing for Wants

Breaking your retirement SIP to buy a car or fund a wedding resets the clock. Keep separate funds for short-term goals.

Shankaran Pillai’s Verdict

Shankaran finally looked at the excel sheet Arun showed him. He saw that by investing just ₹5,000 a month, Arun could potentially have more cash than Shankaran accumulated in a lifetime of land deals.

“Okay,” Shankaran said, adjusting his veshti. “Start one for me too. But put it in a ‘Safe’ fund.”

Actionable Advice:

Don’t wait for the “right time.” The best time was yesterday. The second best time is today. Open your investment app and start a SIP for wealth creation now.

Frequently Asked Questions (FAQs)

Q1: Is ₹1 Crore enough for retirement in India?

It depends on your lifestyle and city. For a Tier-2 city like Kallakurichi, it might be decent. For Mumbai or Bangalore, considering inflation, you might need ₹3-4 Crores by the time you retire in 2040. Always use a 1 crore corpus calculator adjusted for inflation.

Q2: Which mutual funds are best for reaching 1 Crore?

For long-term goals (10+ years), diversified equity funds like Flexi-cap or Index Funds (Nifty 50) are generally recommended. They offer a balance of growth and stability. Consult a financial advisor for personalized advice.

Q3: Can I become a Crorepati with just ₹500 SIP?

Mathematically, yes, but it will take a very long time (over 40 years). To hit the 1 Crore mark in a working lifespan (20-25 years), you need to increase your investment capacity significantly.